A Guide to Buying an HDB BTO Flat

A Guide to Buying an HDB BTO Flat

Thinking of applying for a BTO flat but don’t know where to start? Here is a step-by-step guide on the process, where we highlight the things you should note and share tips for each stage of the application process.

| Content |

| Step 1: Sales launch Step 2: Check eligibility Step 3: Submit application Step 4: Receive outcome of application Step 5: Book flat Step 6: Sign Agreement for Lease Step 7: Collect keys to flat |

Step 1: Sales launch

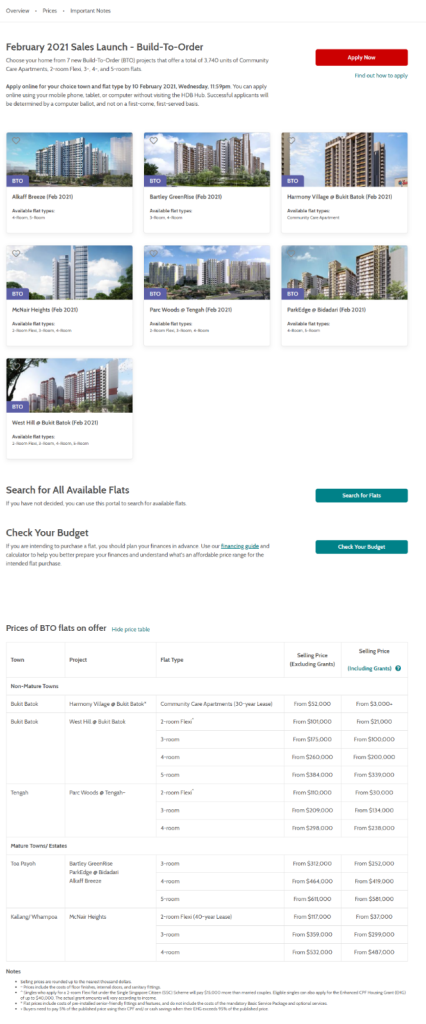

BTO flats are available for application quarterly. HDB will announce the exact application period on the day of the sales launch. So, be sure to follow MyNiceHome, to get first-hand details of the projects on offer!

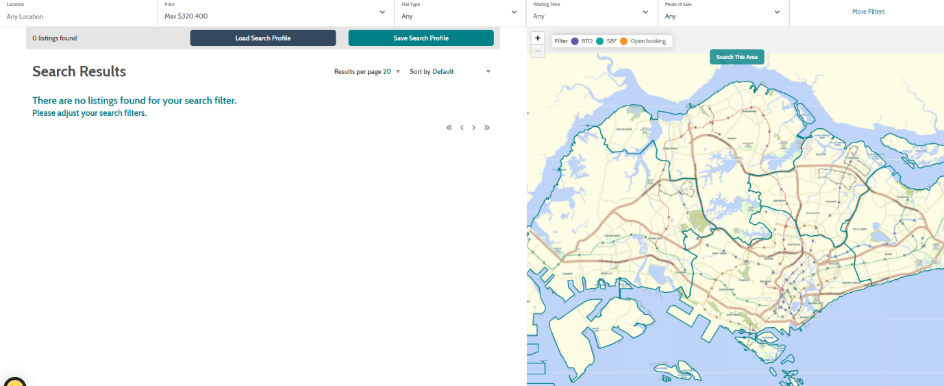

You can also check out the HDB Flat Portal and HDB social media channels (HDB Facebook, MyNiceHome Facebook, Instagram & Telegram). In a typical sales launch, several projects will be launched and applicants will have one week to submit their application.

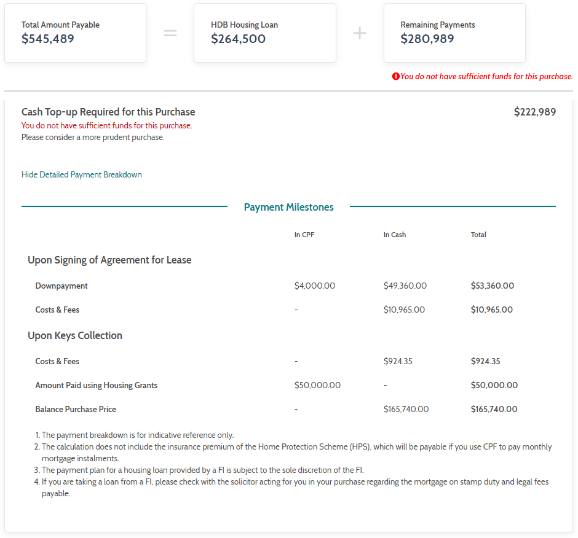

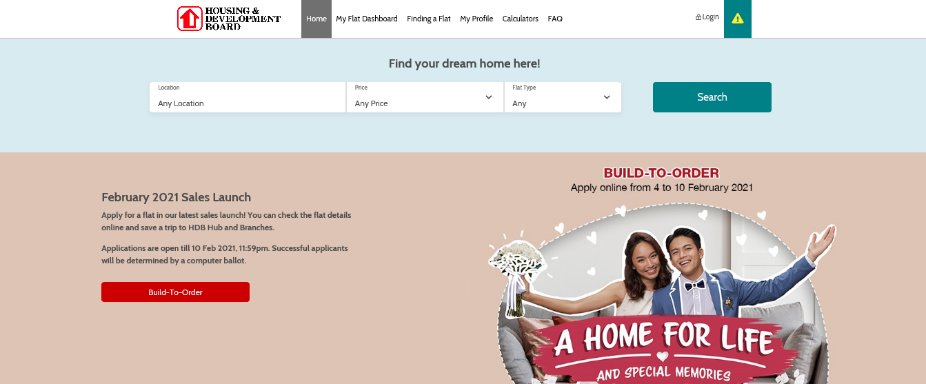

During a sales launch, you will see a banner (like the one pictured below) on the HDB Flat Portal. Click on it and it will lead you to a listing page with prices and information on the projects on offer. Be sure to go through the details and discuss the options with your spouse or co-applicant!

Pro tip: Plan your flat purchase by checking out the HDB Flat portal in advance. The portal lists BTO projects about 3 months ahead of the projects’ scheduled launch and you can find useful information such as the site map, flat types and number of units offered for each project.

Step 2: Check eligibility

Found a flat that you like? Check your eligibility before making an application. You can read the eligibility conditions below and visit HDB InfoWEB for more details.

Overview of eligibility conditions

| Eligible Applicant/ Family Nucleus | • You will need to qualify for a new flat under one of our eligibility schemes: Public Scheme Fiancé/ Fiancée Scheme Orphans Scheme |

| Citizenship | • At least 1 Singapore Citizen applicant • At least 1 other Singapore Citizen or Singapore Permanent Resident |

| Age | • At least 21 years old |

| Incoming Ceiling | • You are within the set income ceiling for the flat you intend to buy |

| Property Ownership | • All applicants and occupiers listed in the flat application do not own other property overseas or locally, and have not disposed of any within the last 30 months • All applicants and occupiers listed in the flat application cannot invest in private residential property from the date of flat application till after the 5-year Minimum Occupation Period (MOP) • You have not bought a new HDB/ DBSS flat or EC, or received a CPF Housing Grant before; or, have only bought 1 of those properties/ received 1 CPF Housing Grant thus far |

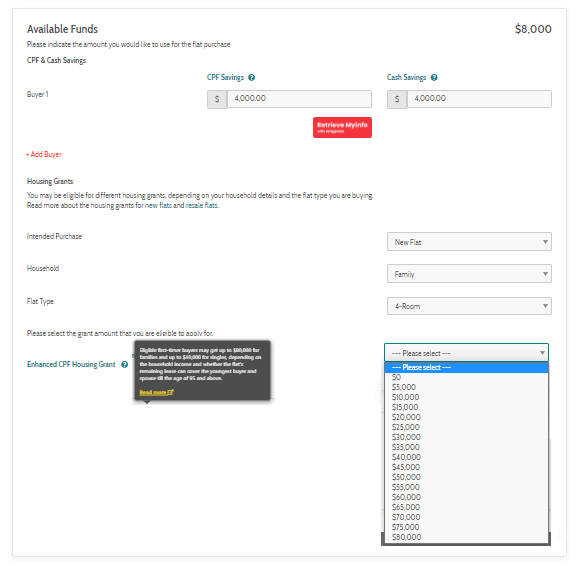

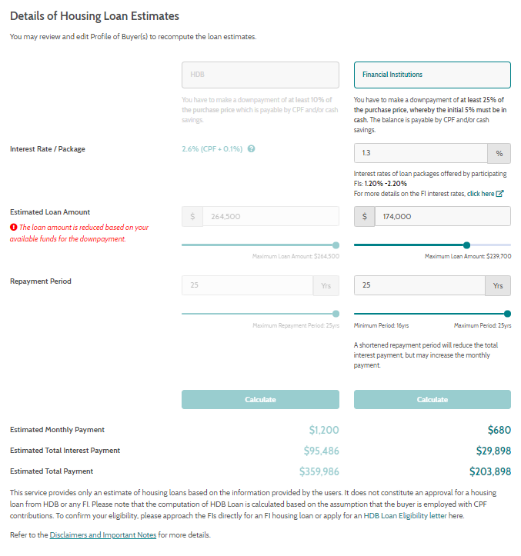

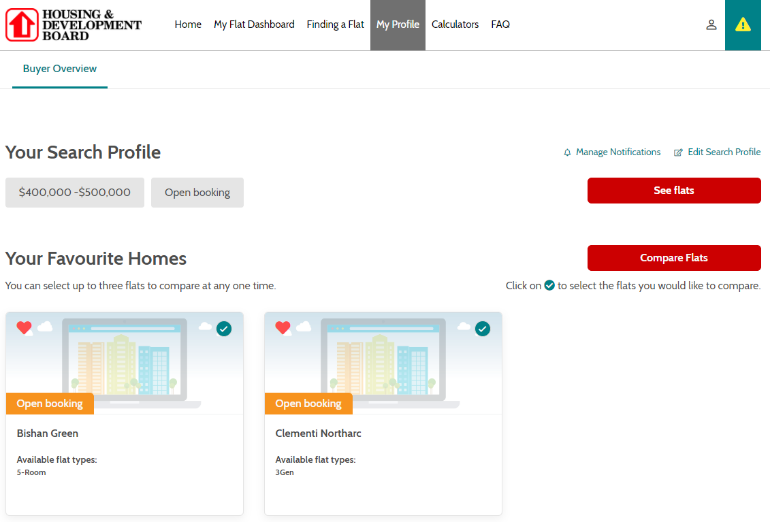

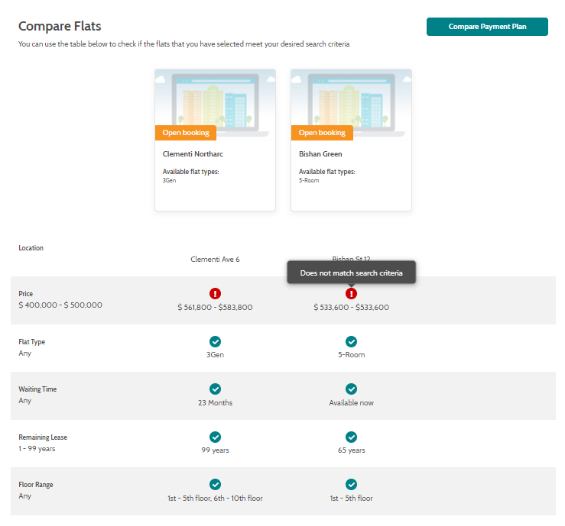

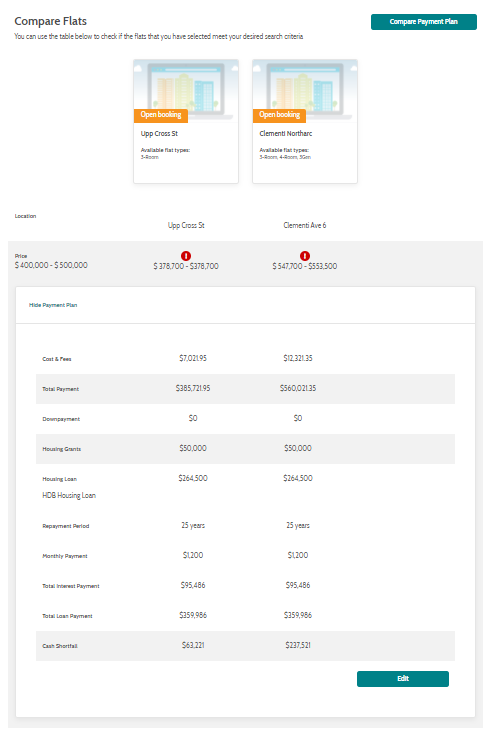

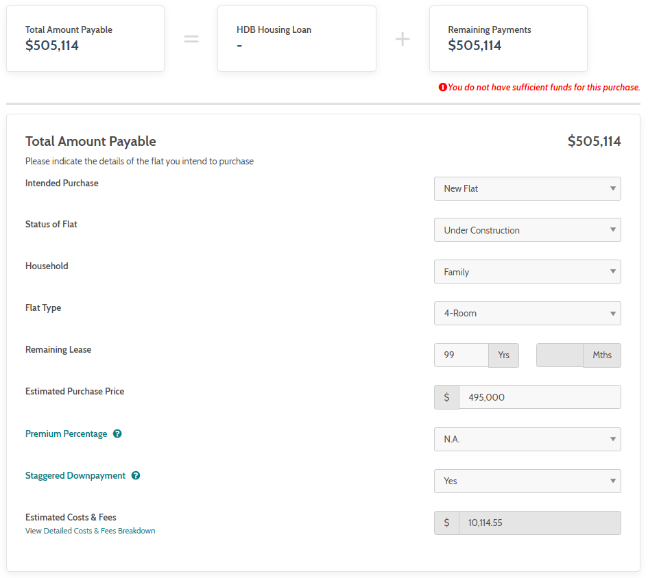

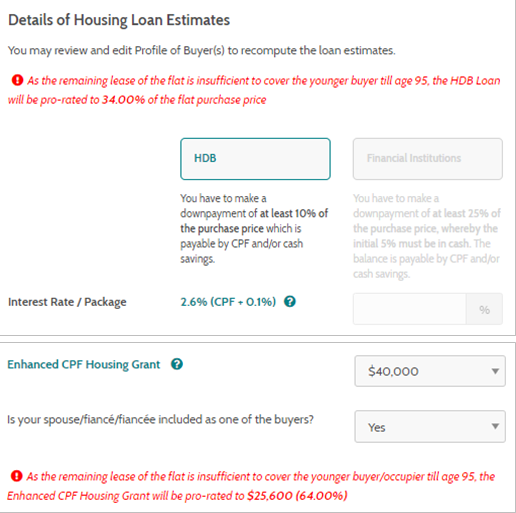

You should also ensure that you have sufficient funds to purchase the flat. Previously, this might involve visiting several websites and webpages, but HDB has made it easier by streamlining the information-gathering process on the new HDB Flat Portal. You can now work out the sums easily with the calculators on the Portal.

Step 3: Submit application

When submitting an online application, applicants will have to pay a non-refundable application fee of $10 via MasterCard/VISA. You have one week to submit your application, but there’s no need to rush as applications are not processed on a first-come-first-serve basis.

At the close of the application period, HDB will process the BTO applications using a computer ballot. This will determine your queue position to book a flat.

Pro tip: You can improve your chances by applying under one of HDB’s Priority Schemes. Also, read this guide on using the HDB Flat Portal to submit your BTO flat application.

Step 4: Receive application outcome

HDB will notify you via SMS, and/or email, on the outcome of your ballot in approximately 3 weeks after the close of application.

Pro tip: You can also visit HDB InfoWEB or log on to My HDBPage to check your application status.

Step 5: Book flat

If your application is successful, you will be invited to book a flat from 4 weeks after the release of the ballot results. Before you head down to HDB Hub at Toa Payoh for your appointment, be sure to have the required documents ready.

During the selection appointment, you will need to pay an option fee – this will form part of your downpayment for the flat purchase. The amount payable varies depending on the flat type. Payment has to be made via NETS.

| Flat Type | Option Fee |

| 4/5 room Executive | $2,000 |

| 3-room | $1,000 |

| 2-room Flexi | $500 |

If you are applying for the Enhanced CPF Housing Grant, you will need to submit the application form during the appointment.

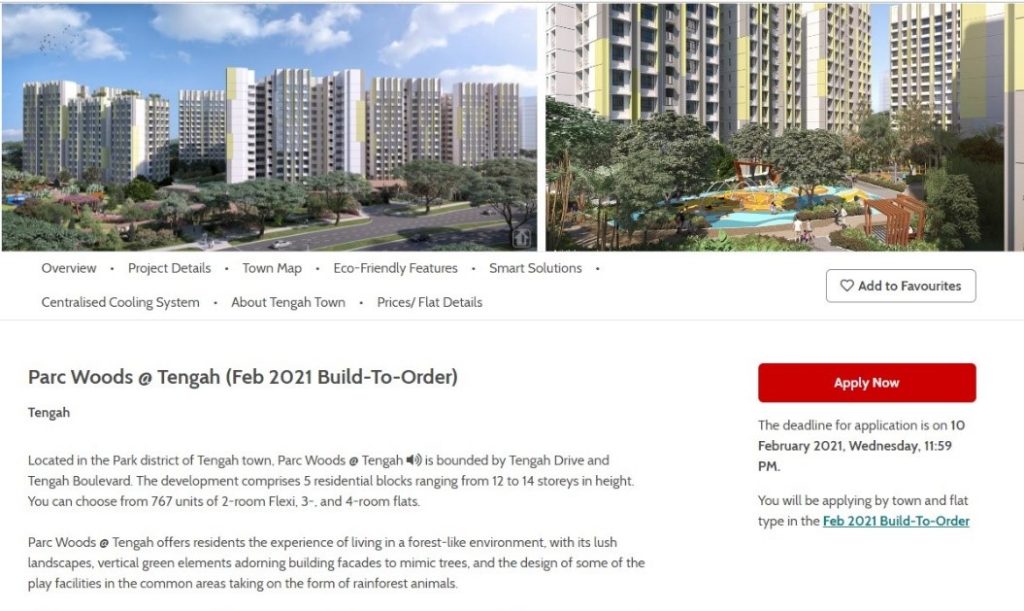

Pro tip: With the new HDB Flat Portal, you can create a watchlist of your preferred units and receive notifications if and when they have been booked by others.

Step 6: Sign Agreement for Lease

From 6 months after booking your flat, HDB will invite you to sign the Agreement for Lease. Ensure that you have the necessary documents with you.

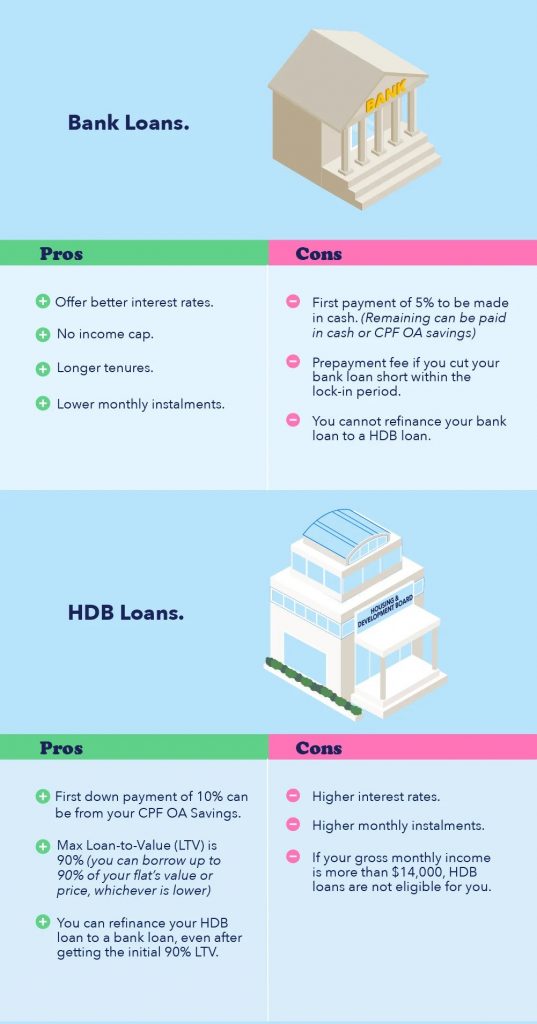

This includes a valid Home Loan Eligibility Letter (HLE) from HDB if you are taking an HDB housing loan, or a Letter of Offer if you are taking a housing loan from a financial institution (FI).

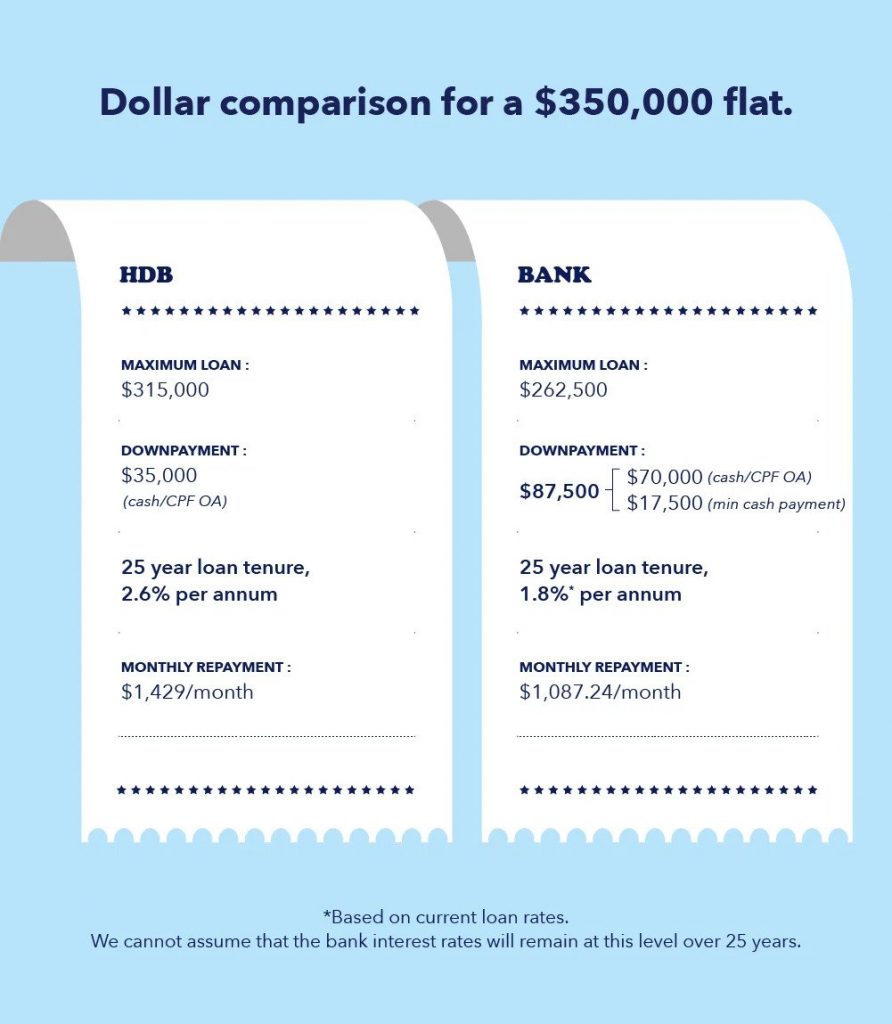

You would also need to make a downpayment for your flat. The amount depends on the type of loan you are taking. For HDB Loan, it is 10% of the purchase price and it can be fully paid for using the CPF funds in your CPF ordinary account.

For a loan from an FI, it is 20% of the purchase price, of which at least 5% must be paid using cash and the remaining can be paid using your CPF savings.

As the maximum loan quantum granted by financial institutions is 75% of the purchase price, you will have to pay the balance 5% of the purchase price using cash or CPF savings when you collect the keys to your flat. The actual cash quantum would depend on the maximum loan ceiling.

For payment using CPF savings, you would need to access your Singpass and your mobile phone or OneKey token for 2-factor authentication. The registration for Singpass and activation of 2FA will take up to 10 working days. So be sure to prepare these in advance!

Pro tip: There are several factors to consider when deciding between an HDB housing loan or a loan from an FI. Check out this article to compare the differences between the two financing options.

Step 7: Collect keys to flat

When construction of your flat is completed, HDB will notify you to make a trip to its office to collect the keys to your flat. The key collection process is straightforward and you will be guided by experienced HDB officers. Have the necessary documents with you, collect your keys and congratulations on becoming a home owner!

Pro tip: Planning for your home renovation is a creative process which takes time! Start early with this Guide to Planning Your HDB Home Renovation.