My Resale Flat Journey: First Property is 30-Year Old Resale Flat

My Resale Flat Journey: First Property is 30-Year Old Resale Flat

The post ‘My Resale Journey: First Property is a 30-Year Old Resale Flat’ appeared first on the MoneySmart blog

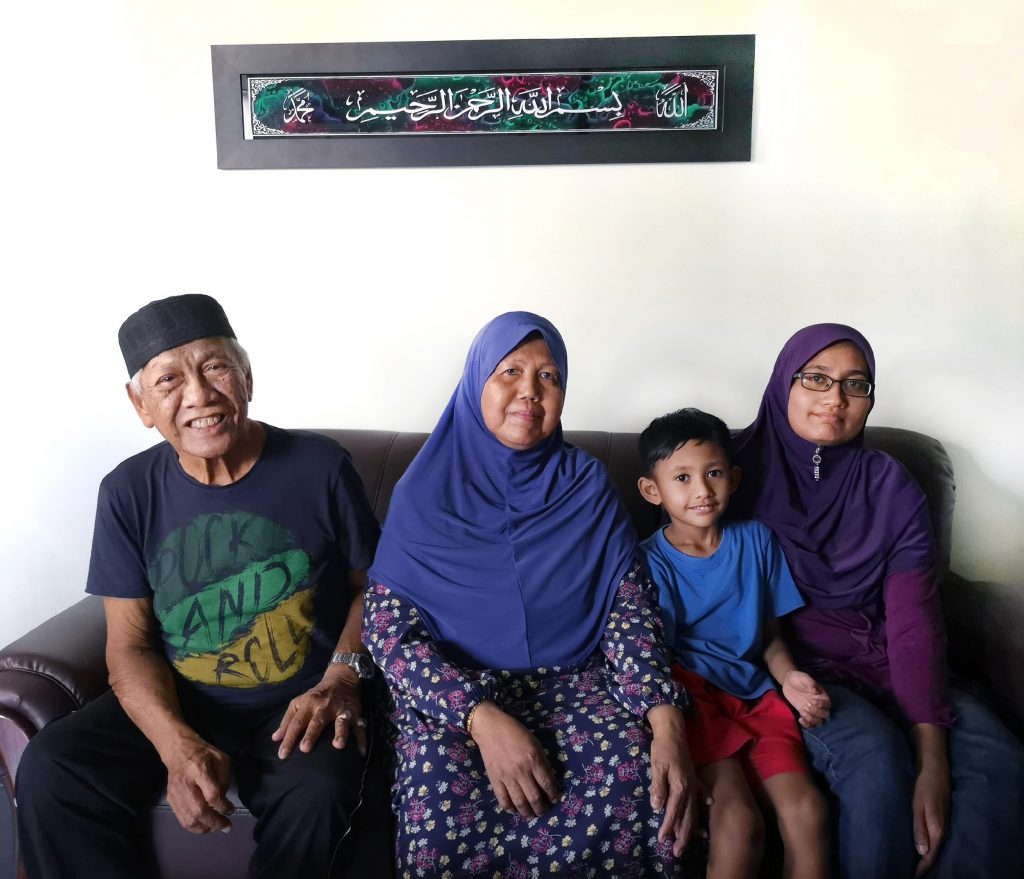

Mr Wong, 32, and his wife, Madam Lai, 31, are on the cusp of moving into a resale flat in Jurong West with their child, as well as Madam Lai’s brother and sister-in-law.

The couple’s 5-room flat has just been renovated, and they are now putting the finishing touches to their new home.

In this second part of a 3-part series in which we present the stories of resale flat buyers, we spoke with Mr Wong on his new home and the process he went through to purchase his resale flat.

About The Flat

Owner: Mr Wong Bin Hao, 32, married with 1 kid

| Location | Jurong West |

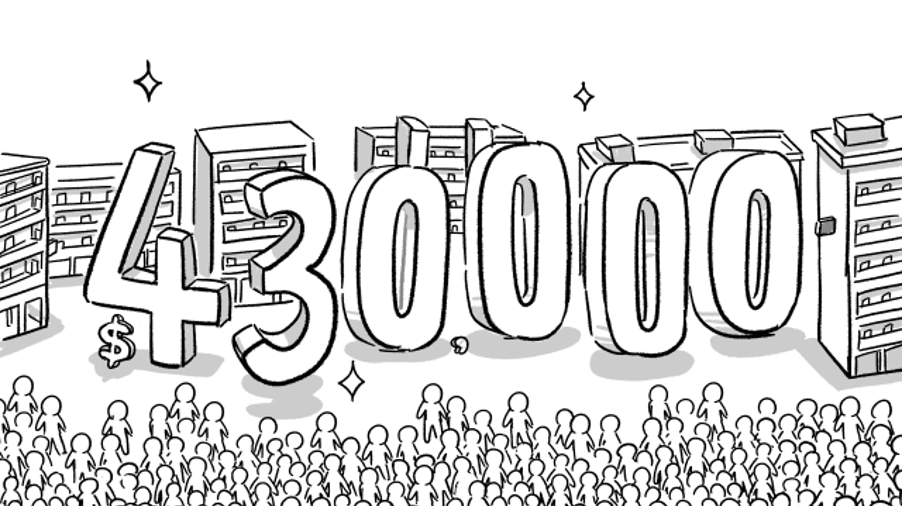

| Flat Price |

$335,000 (after $40,000 housing grants) |

| Year of Purchase |

2018 |

| Flat Type & Size | 5-room flat/ 121 sqm |

| Remaining Length of Lease | 69 years (as of May 2019) |

| Monthly Mortgage Amount & Loan Tenure |

About $1,600 18 years |

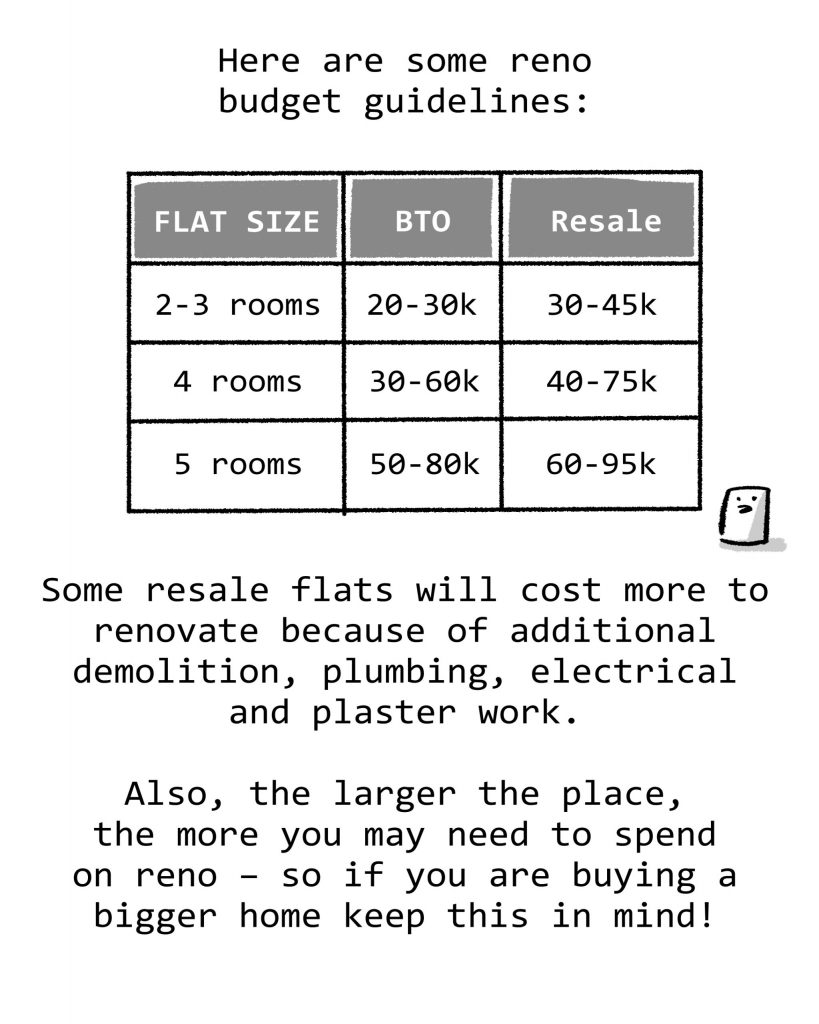

| Renovation Cost | About $35,000 |

When we visited Mr Wong’s flat at Jurong West Avenue 5, workmen were finishing up their final renovations.

But the flat already looked cosy and inviting, with a comfy couch and a pile of Hello Kitty cushions beckoning us as we entered.

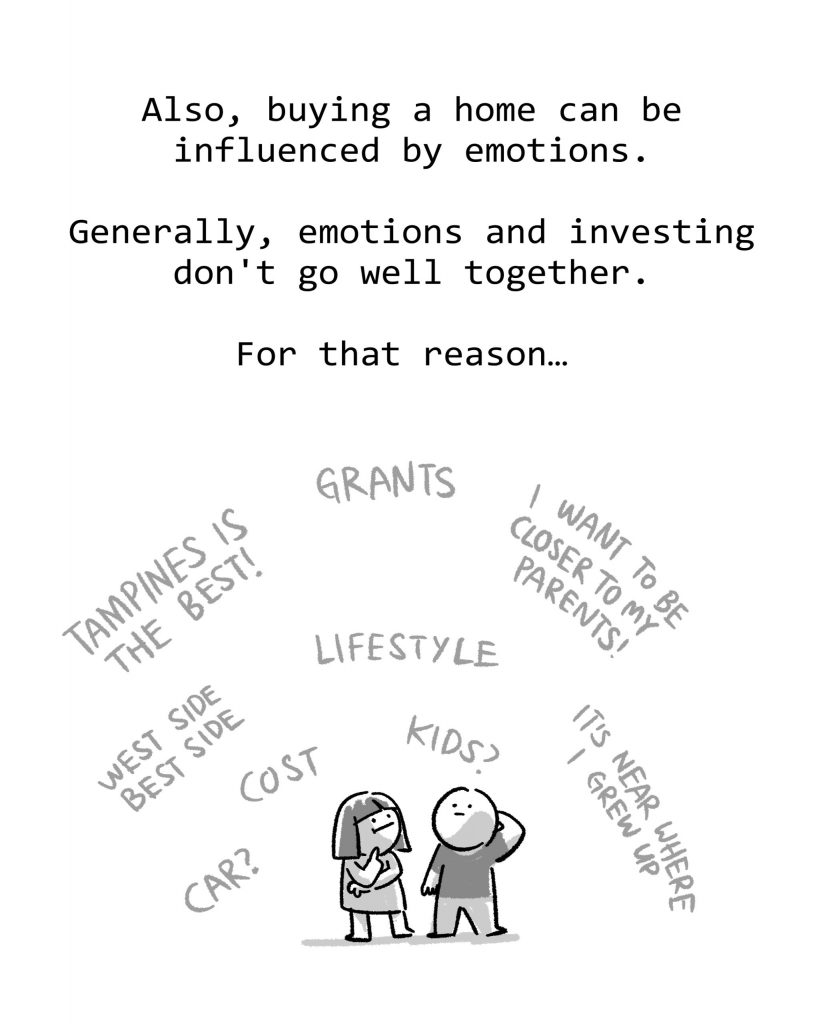

MoneySmart (MS): Mr Wong, how did you and your wife decide to buy a flat in Jurong West?

My wife and I both work in the Jurong area. For a period of time, we rented in nearby neighbourhoods and moved around.

I have been living in Jurong West for about three to four years. I’ve always found this area quite lively and naturally, wanted to buy a home here.

MS: Besides the fact that it’s lively, what else about this place appealed to you?

My two-year-old kid goes to the childcare centre in this block. You can also see the playground from here so it’s perfect and convenient for us. There are some primary schools close by that my child can attend in the future.

There are also two malls nearby, Pioneer Mall and Gek Poh. When the future Jurong Region Line is up, we will be within walking distance to an MRT station, so I think it was worth the buy.

MS: You started out renting a flat. What made you decide to take the plunge and buy your own place?

For me, having that sense of ownership is important.

When you rent, you might need to move from time to time, like what happened to us in the past. I found it tiring to be moving from house to house every year or so.

Some landlords are also not prepared to accept tenants who keep different hours or lifestyles. At the start they may say everything is okay, then suddenly they become fussy and impose curfews on the tenants.

There are uncertainties when you rent a place with friends too – they may need to move elsewhere and you will need to find another flat mate.

When I rented a place, I had to pay the landlord rent in cash every month, and could not make use of my CPF savings. Now, I can pay my housing loan instalments using CPF, so I don’t really need to fork out cash. For all these reasons, I feel it is good to have my own flat.

MoneySmart Tip: You can use this service to work out an estimated financial plan for the purchase of a resale flat if you are taking an HDB loan.

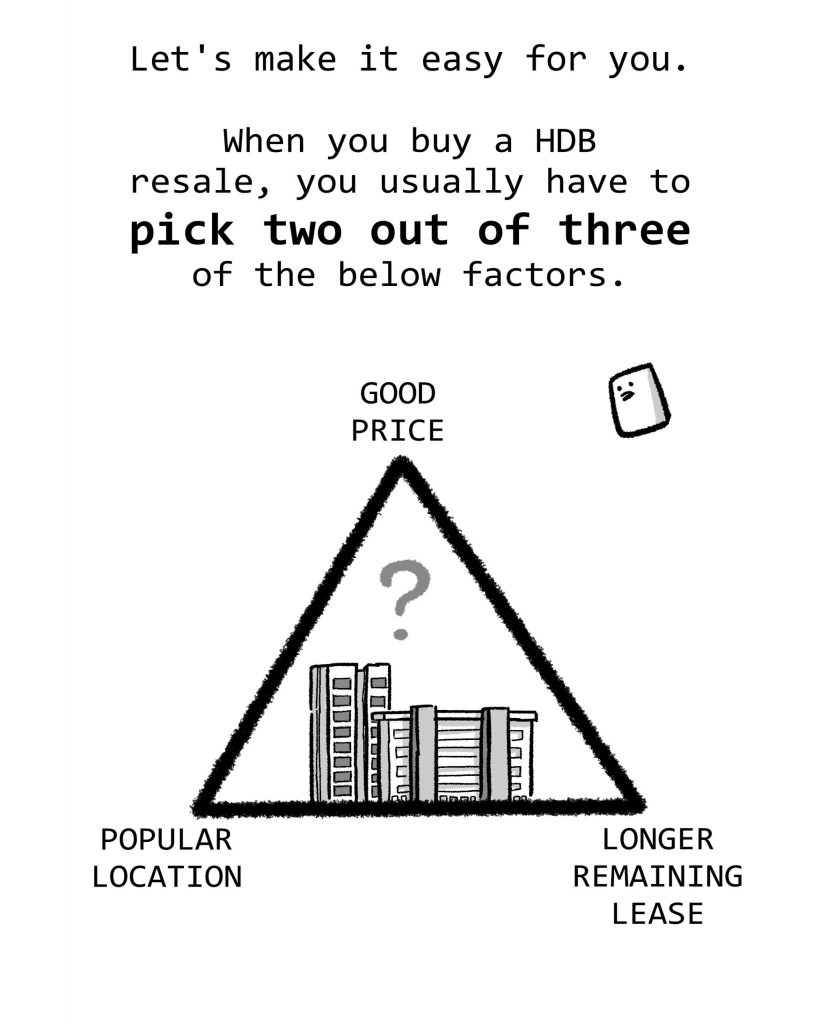

MS: We understand that your flat is about 30 years old. Was its age a concern for you?

One reason why I bought a resale flat is that it is more spacious for my family. This flat is about 120 sqm and the kids have more space to run around. Sometimes my parents or my wife’s parents will visit. So it’s better to have more space.

We still have 69 years left on the lease which is good enough for us. Our children and future generations are likely to buy their own homes anyway, so we don’t need to worry about leaving this flat for them. As we are planning to use this flat as a home, I think it’s good enough. For the next generation, you don’t need to bother as the kids will buy their own homes.

Although this is an old estate, the area is well taken care of by the Town Council and HDB also carries out upgrading of the flats.

MoneySmart Tip: Use this online map service to get lease information, resale prices, and even season parking information for each housing block. You can filter through nearby amenities to see where to dine and shop.

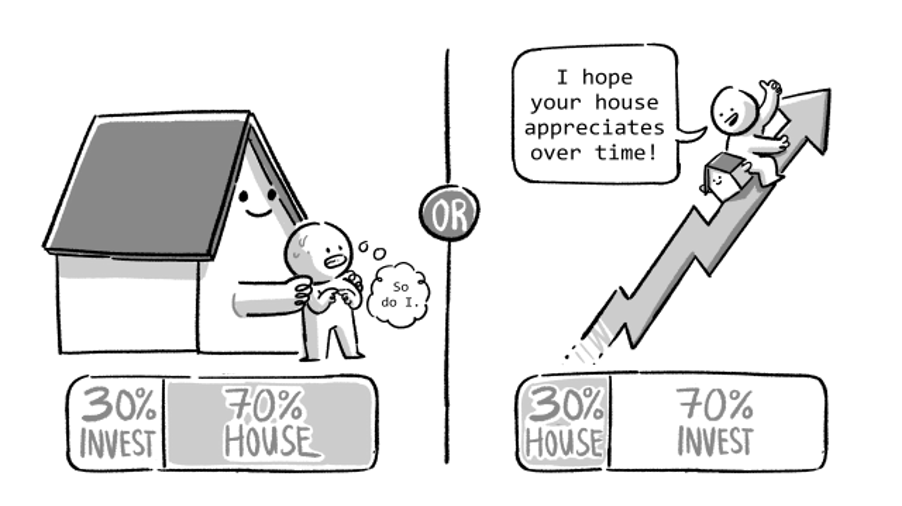

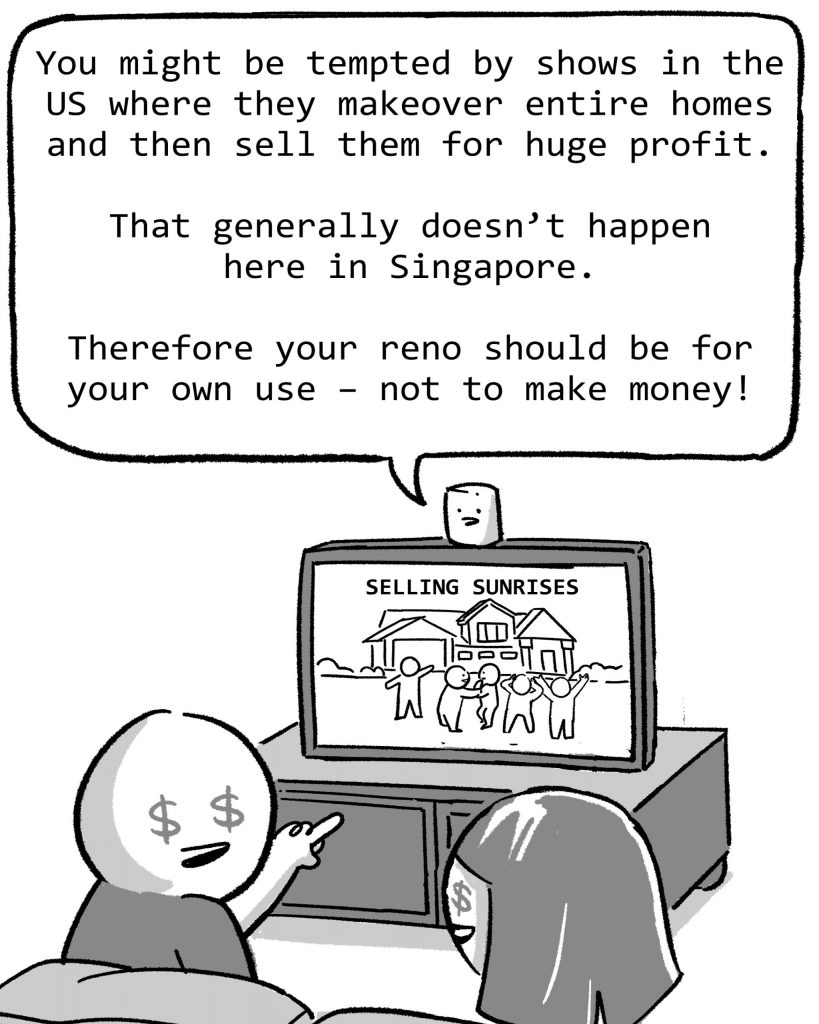

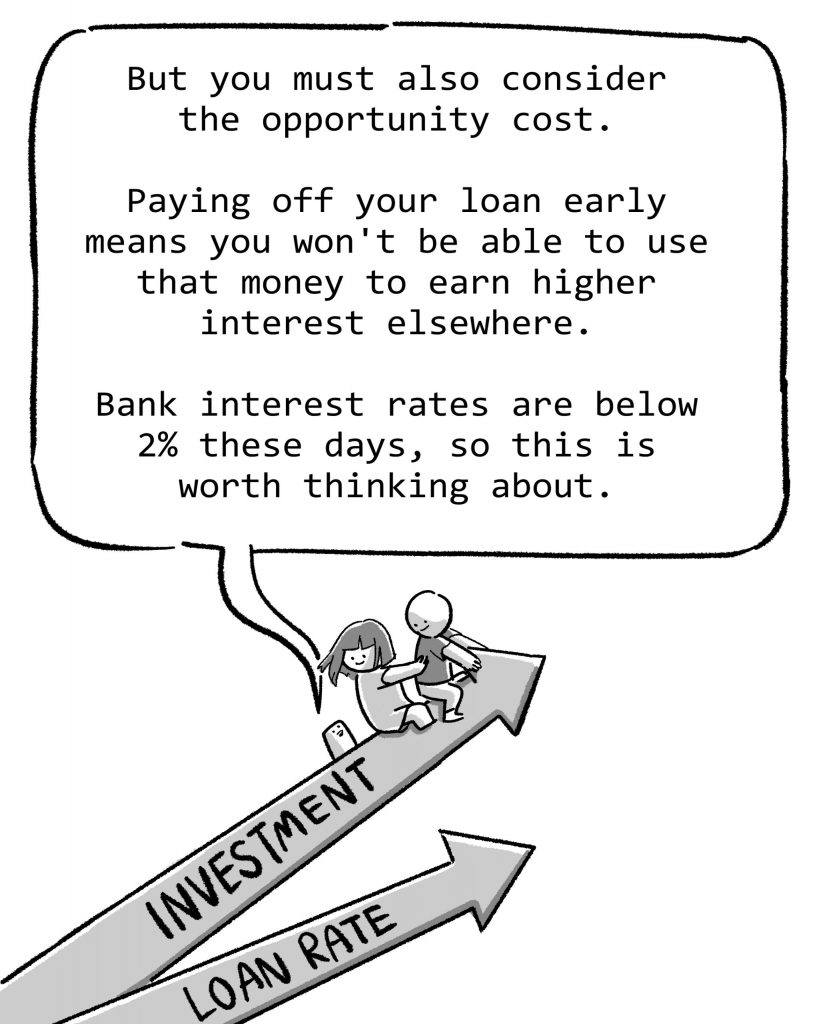

MS: Do you see your flat as an investment?

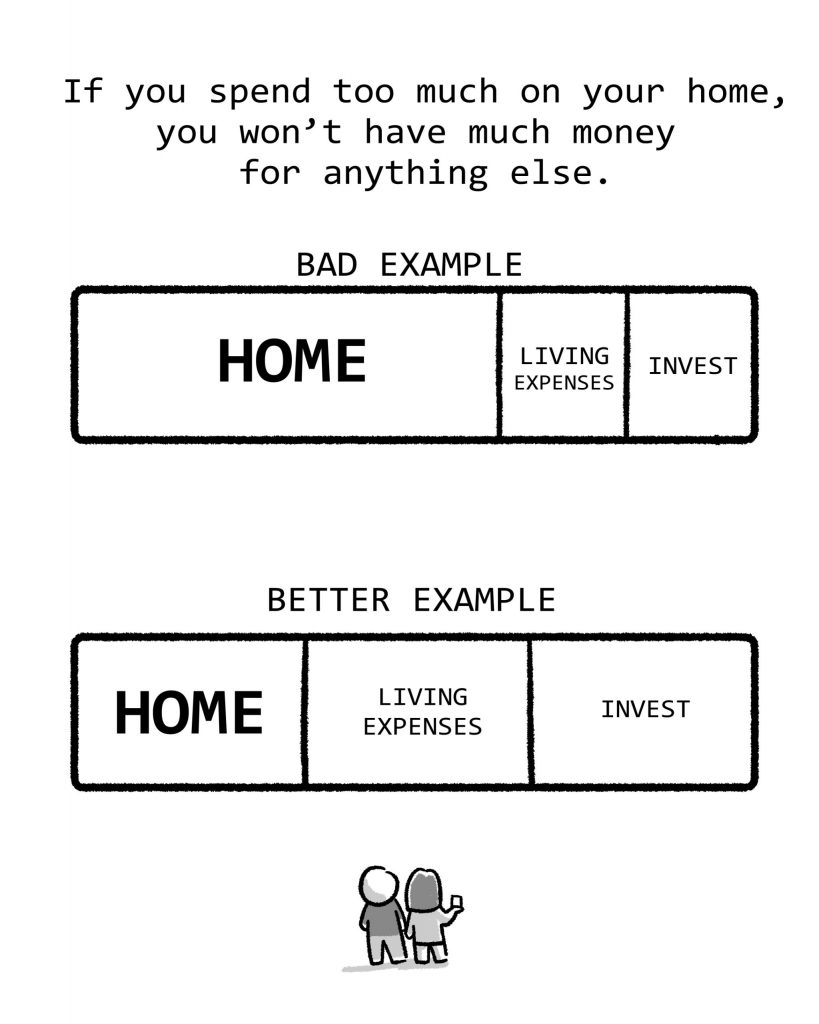

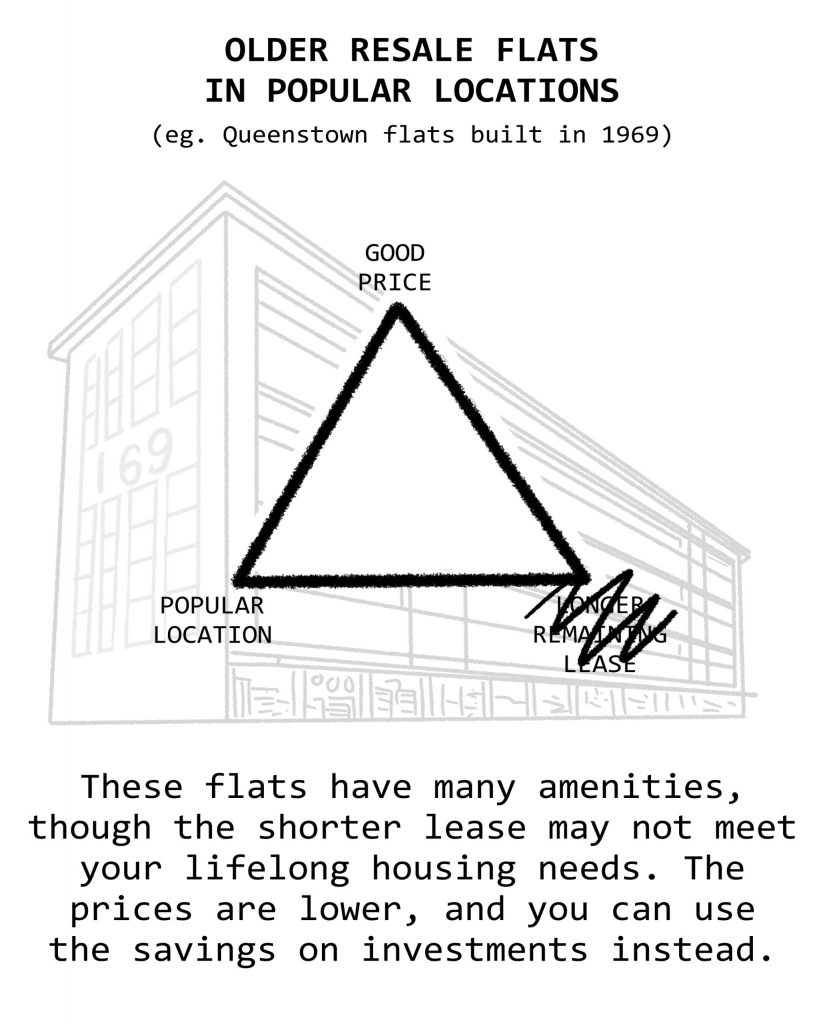

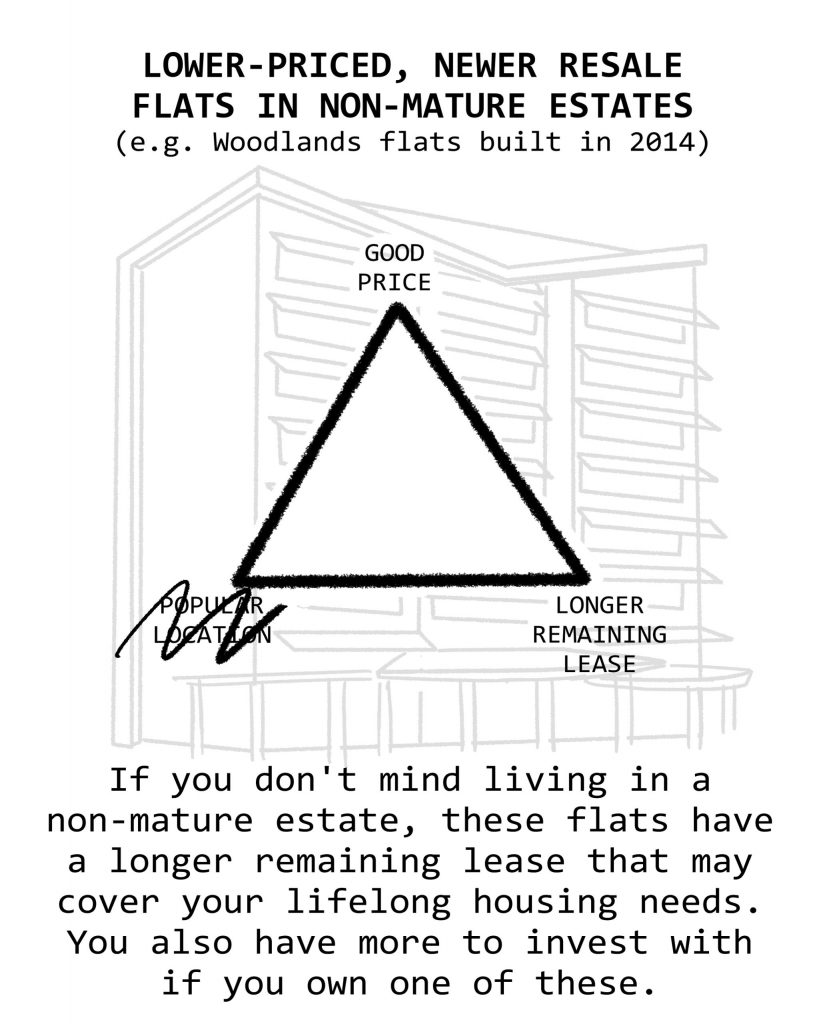

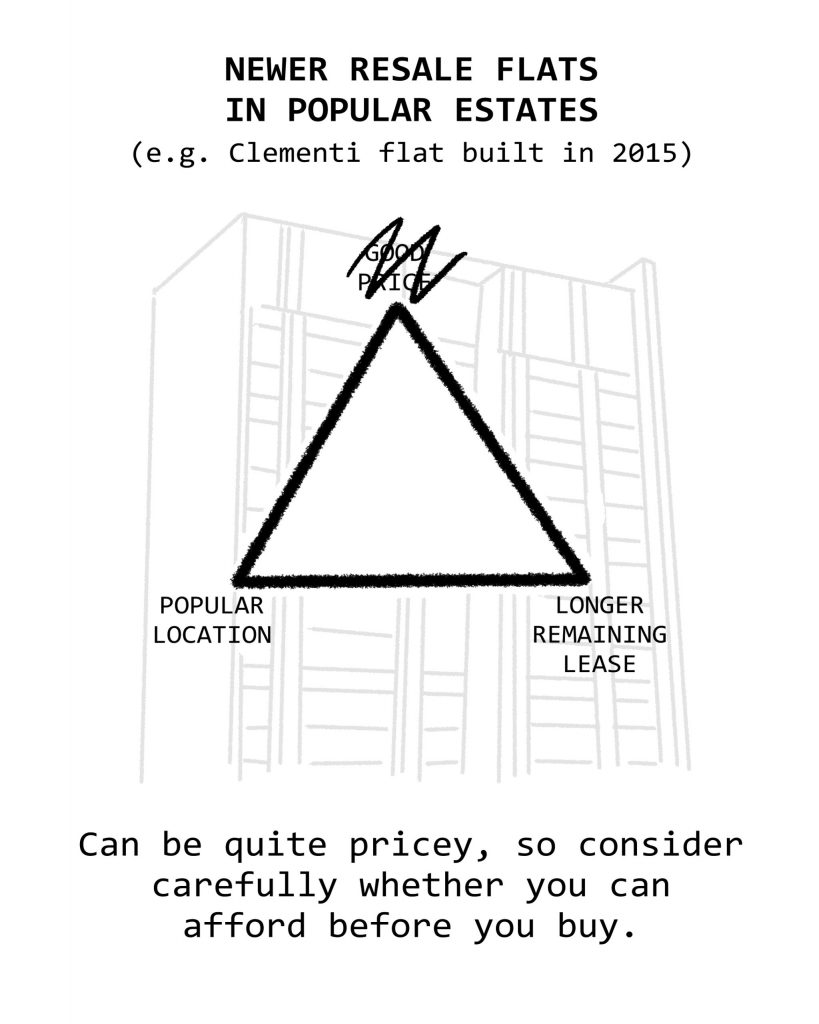

When we were weighing the pros and cons of buying a 30-year-old flat compared to a newer one, we did think about this issue. However, we feel that a house is for the long-term and one that would see us through our old age. Instead of hoping to make a profit from moving houses, we would rather stay in one flat and finish paying our housing loan sooner, so that we can free up our finances for other things.

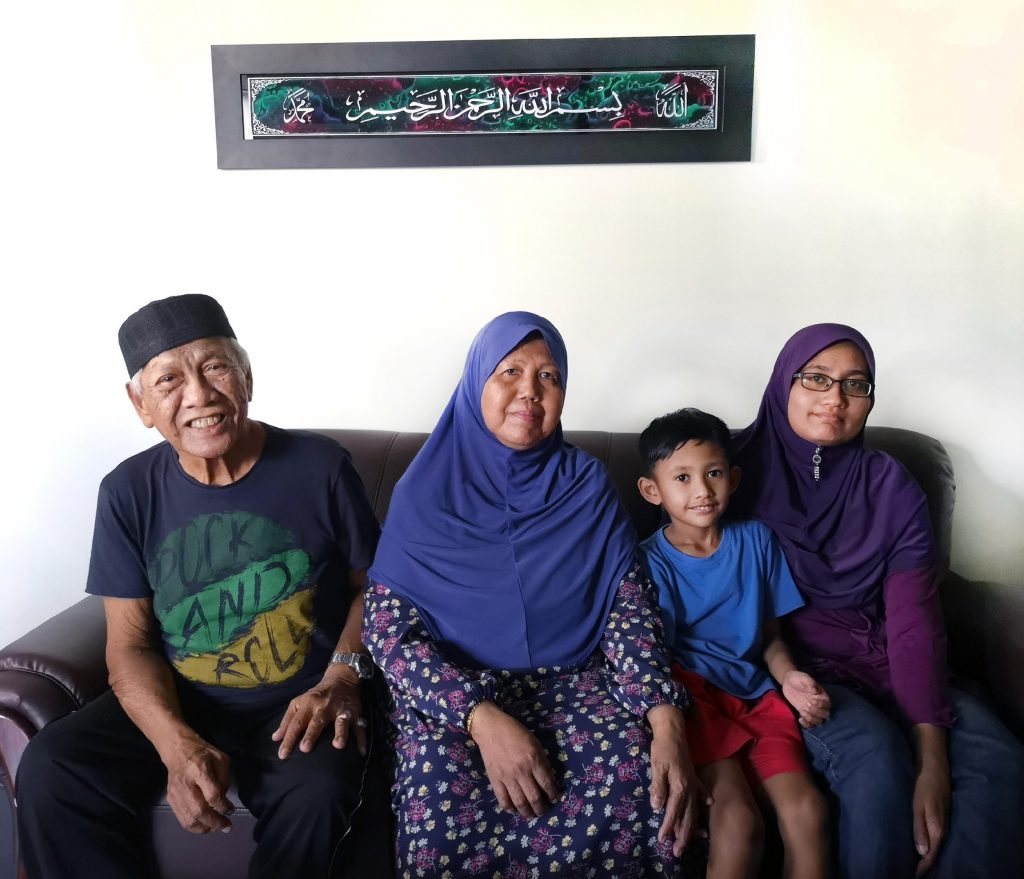

MS: How was the purchase process? Did you go through an agent or DIY?

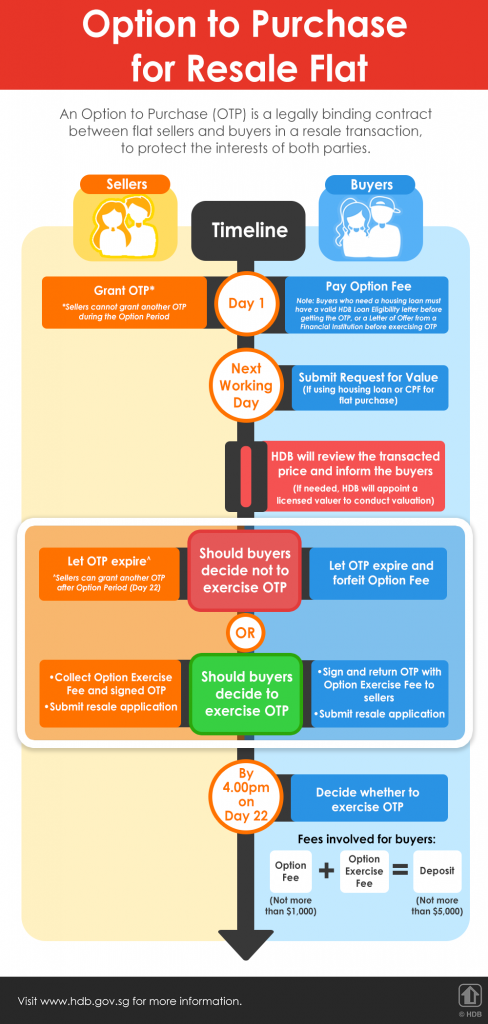

We initially tried to DIY by using a property website, but later on we received calls from estate agents offering their services and we engaged an agent eventually. He asked us what sort of attributes we wanted in a flat, and helped us to look for suitable flats that were within our budget.

Everyone has different interests and needs, so it’s important to know what your own needs are, before you decide whether to engage an estate agent for your resale transaction.

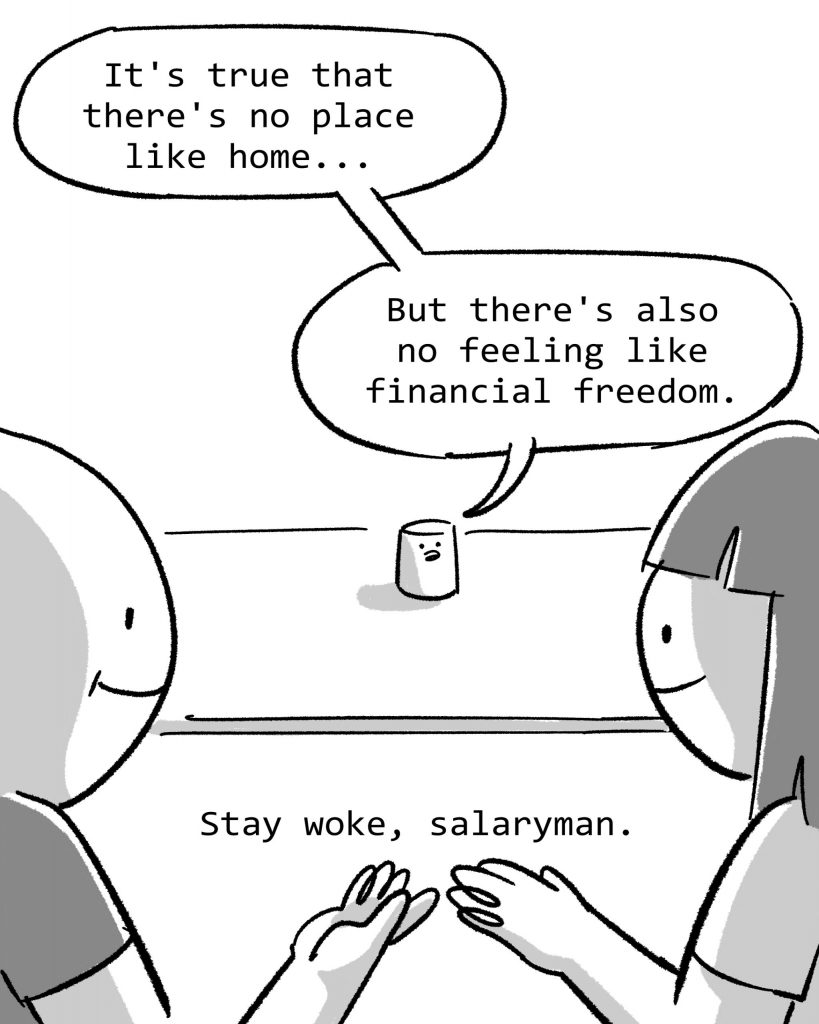

MoneySmart Tip: We asked Mr Wong if he knows about HDB’s Resale Portal, and he says he doesn’t. The HDB Resale Portal could have guided him in the buying journey. It takes buyers and sellers through the buying and selling process in a step-by-step manner online and allows them to DIY their transaction if they choose not to engage an estate agent.

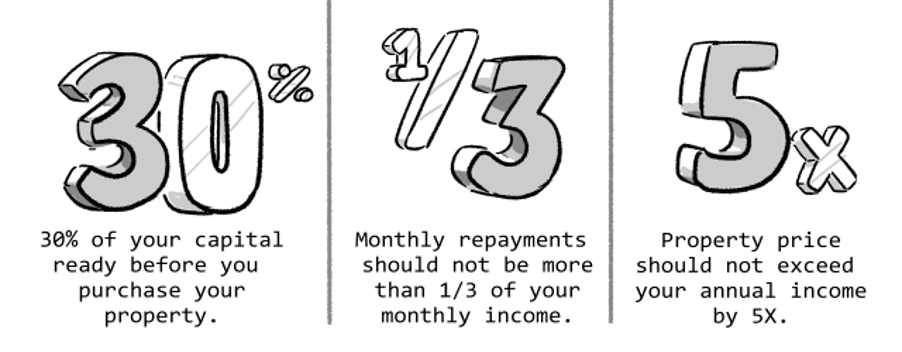

MS: How is your flat being financed?

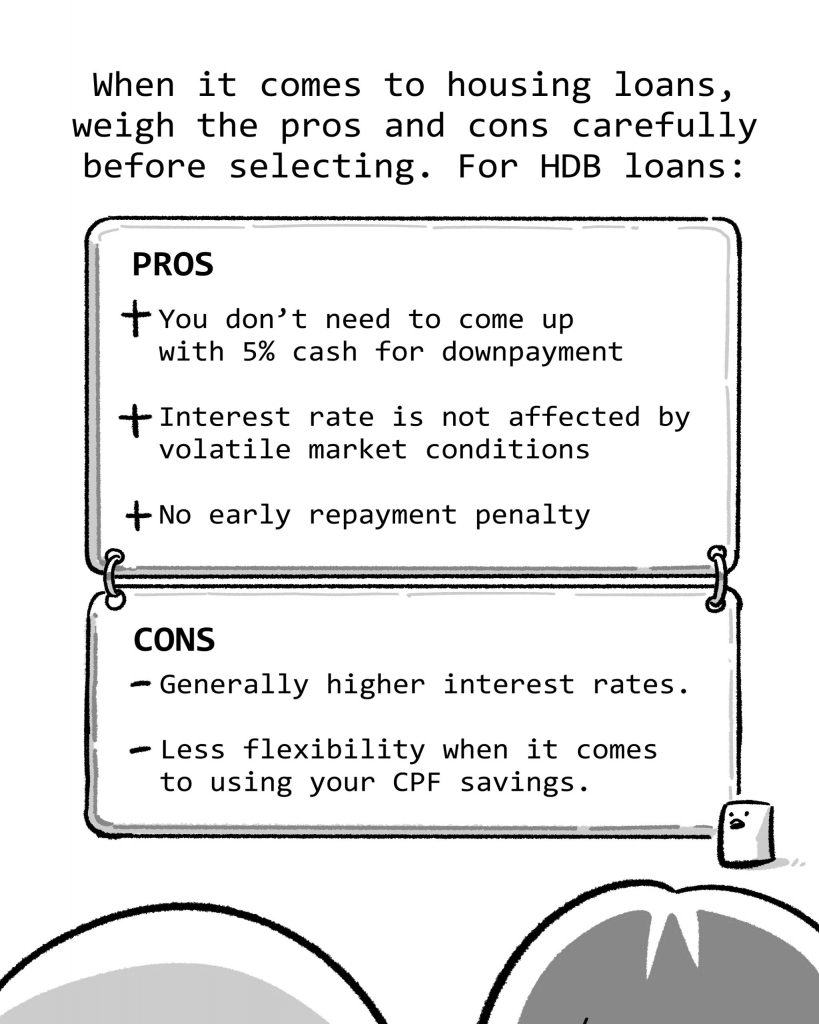

We went for an HDB loan as we found it less complicated than going for a bank loan. For bank loans, the interest rate is a bit uncertain.

Although the HDB loan interest rate is currently higher than for bank loans, the difference is not that much after you do the math.

Initially we indicated that we wanted to settle the loan in 10 years. Then HDB called us to ask whether we wanted to reconsider. Based on our salary, they recommended an 18-year loan tenure so that we can buffer for things like employment changes or if we suddenly need cash for urgent reasons. They explained that we can make partial capital repayment or even redeem the loan earlier if our finances permit. We found the advice useful. My wife and I are planning to settle the loan earlier to incur less interest and save more for retirement.

MoneySmart Tip: Find out how you can make partial capital repayment or fully redeem your HDB loan and save on housing loan interest.

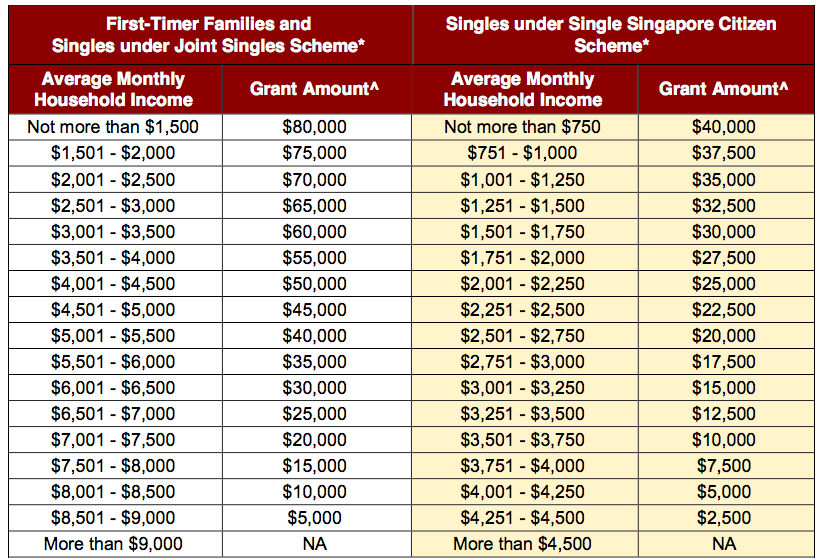

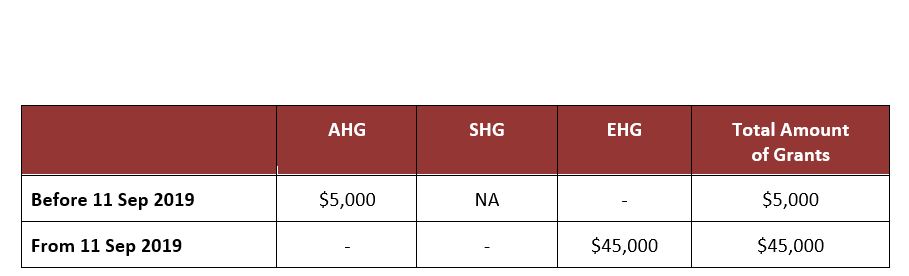

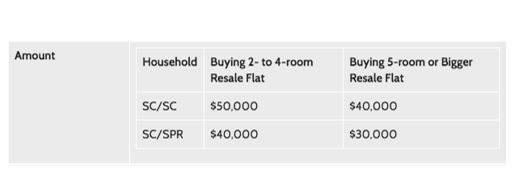

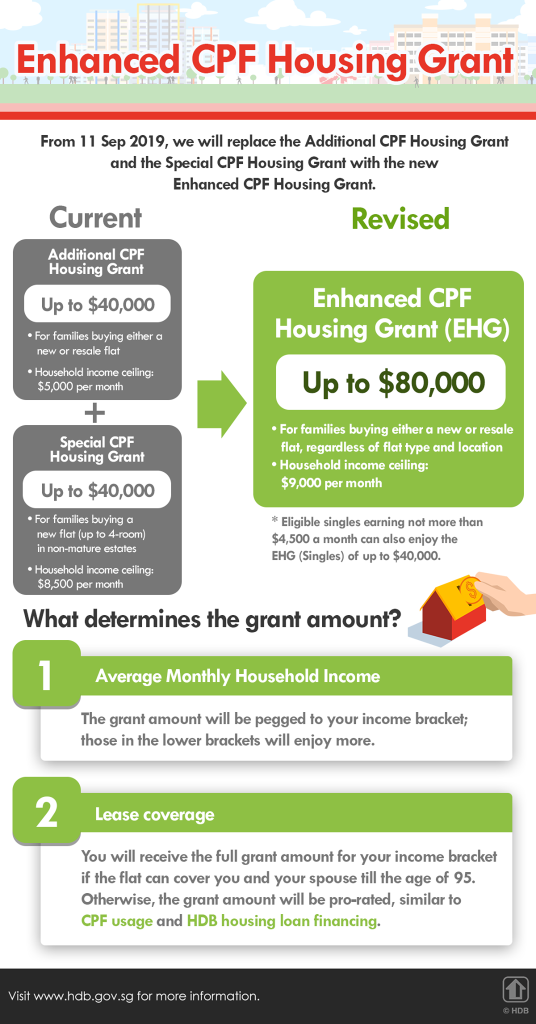

MS: Did you get to enjoy any grant?

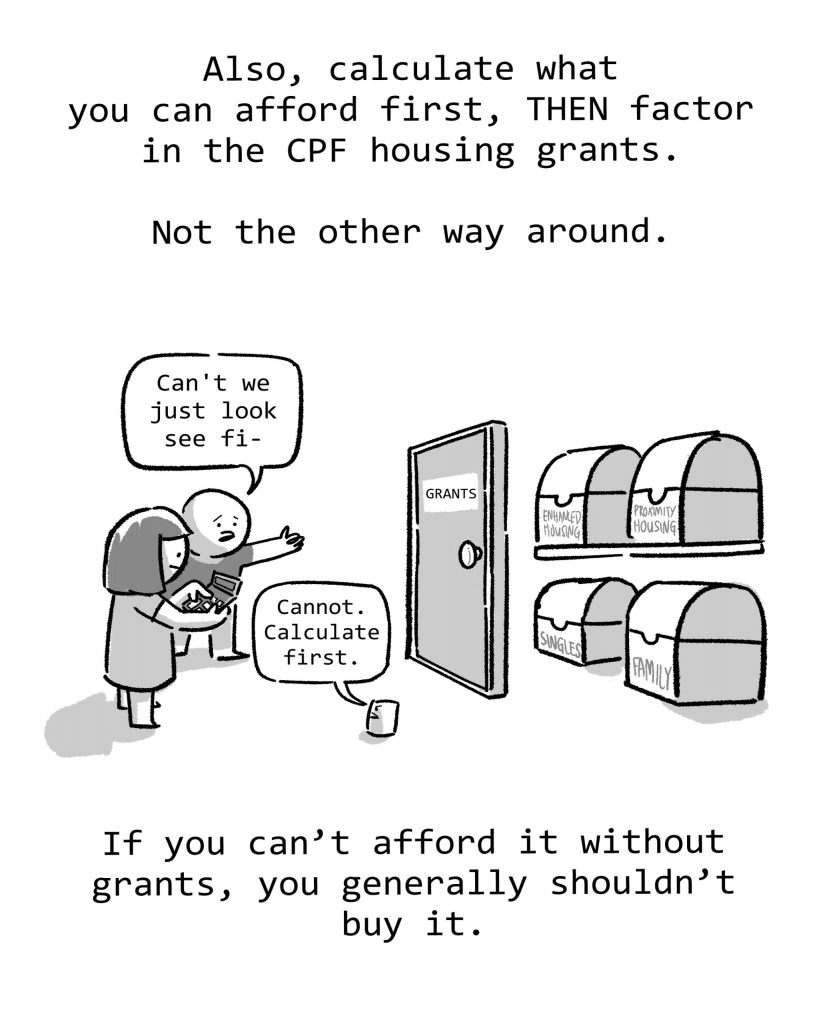

We got the housing grant for first-time buyers, which was a really attractive sum. We initially set aside a bigger budget as we thought we would not be eligible for grants. So for us, getting the grant was a bonus.

MoneySmart Tip: Find out what grants you qualify for, so you can plan your finances for your new HDB home.

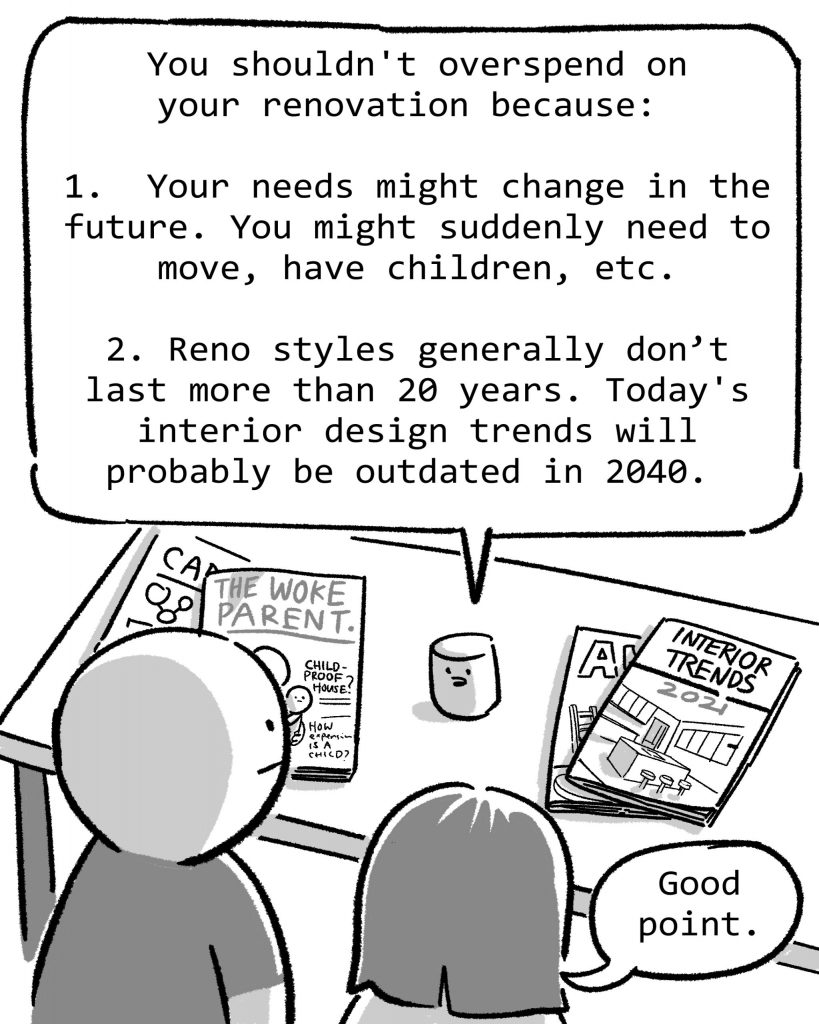

MS: How has the renovation process been like?

We spent about $35,000 on renovations, mainly for works in the kitchen and for furnishings around the house. This includes $16,000 paid to our contractor, who was flexible to work with.

We did not hire interior design firms as we found their prices quite high. Since we wanted to save money, we thought it was better to work directly with contractors. For example, the rewiring cost quoted by the contractor was cheaper than market rate!

MS: Any advice for aspiring homebuyers?

You don’t really need to look for flats with fanciful fittings, because you will probably have to do your own renovations anyway. For example, even if the flat comes with nice flooring, the colour of the tiles may be uneven after the previous flat owner has removed all their furniture. So you might still need to replace the floor tiles.

MoneySmartTip: Planning your renovations for your HDB flat? Know what’s important to note and familiarise yourself with the guidelines.

Source: mynicehome.gov.sg