My Resale Flat Journey: From West to East

The post ‘My Resale Journey From West to East’ appeared first on the MoneySmart blog

This article was updated on 25 May 2021.

Conversations around public housing usually revolve around affordability, value, and financing. Beyond the dollars and cents, it’s hard to get a tangible sense of what owning a flat means to people, and the significance of having a home to call their own.

We spoke to different homeowners, specifically those who had bought resale flats, to get their thoughts about their home and flat buying journey. In the first of our 3-part series, we speak to Mr Ismail, who has lived on both sides of the island.

About The Flat

Owner: Mr Ismail bin Hamid, 41, Married with 4 kids

| Location | Tampines |

| Flat Price | $410,000 (after $20,000 Proximity Housing Grant) |

| Year of Purchase | 2018 |

| Flat Type & Size | 4-room flat/ 104 sqm |

| Remaining Length of Lease | 63 years (as of Apr 2019) |

| Monthly mortgage amount & loan tenure | Nil (fully paid after selling previous flat) |

| Monthly mortgage amount & loan tenure | About $38,000 |

MoneySmart (MS): Mr Ismail, this is an amazing looking house. Tell us a little bit about why you chose to buy a flat here.

Mr Ismail: Tampines has been my home for the past 7 years. This flat is located 2 blocks away from where I grew up in, so this is a neighbourhood I am very familiar with. In fact, one of my primary school classmates still lives in the next block with his own family!

When I was growing up, there was only Bedok Interchange. There was no Tampines Interchange, and the Downtown Line certainly didn’t exist at that time, so you can imagine that getting around was very different from how it is now.

MS: Tell us a bit about your housing journey.

Mr Ismail: After I got married, my wife and I moved to Bukit Batok, which was near her family. It was a very different area from where I grew up, so that was something new. We then moved to a resale flat in Bukit Panjang. With convenience and proximity to family being a key consideration, we decided not to wait for a suitable BTO flat. At that time, the only available BTO flats were in Sengkang and Punggol, so we chose to buy a resale flat.

Due to family circumstances, we eventually moved back to the East, a few streets away from where we are currently staying now.

MoneySmart Tip: Interested flat buyers can get information on upcoming BTO projects 3 months before sales exercises for better planning. In the meantime, you can visit HDB InfoWEB for details on the upcoming BTO sales exercise.

MS: We also understand that you moved from a 5-room to a 4-room flat?

Mr Ismail: We felt that it was a much better idea to move to a 4-room flat because there was a lot of unused space in our previous 5-room flat. Even though we have four kids (aged 12, 9, 8, and 3), we felt that this current place suits our needs perfectly.

As you can see, the amenities around this place are great for our kids. We also considered the fact that there was a park that was very accessible and our kids wouldn’t have to cross any major roads to get there.

At this point, Mr Ismail’s wife also chimes in, highlighting the fact that the 4-room flat is much easier to clean than their previous home. They also managed to completely pay off their housing loan after moving, but more on that later.

MS: Tell us about your home buying process. Did you engage an agent or do it on your own?

Mr Ismail: We decided to go with an agent, and the reason was that our housing agent was also my friend from reservist! He also helped us to sell our previous home. I would say when it comes to engaging an agent, it definitely helps to have someone who knows his stuff.

It was an easy decision to buy our current home because we knew what we wanted, and the opportunity presented itself. I would say our only regret is that we missed out on a flat that is near the newly built Our Tampines Hub. There was nothing there at that point in time and we had no idea they were going to build an integrated community hub there!

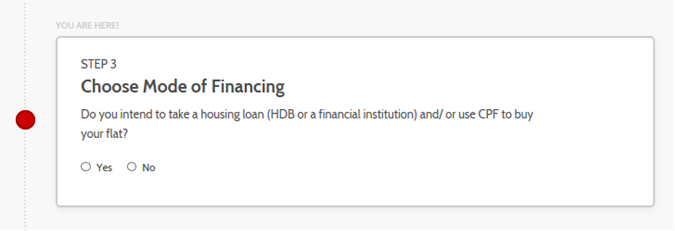

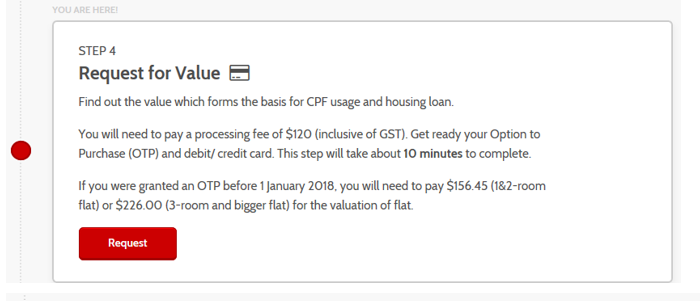

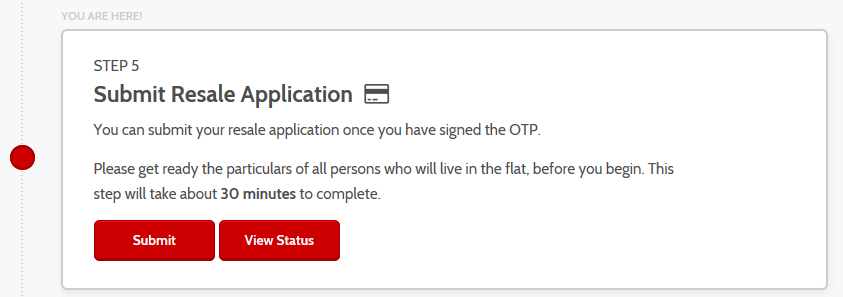

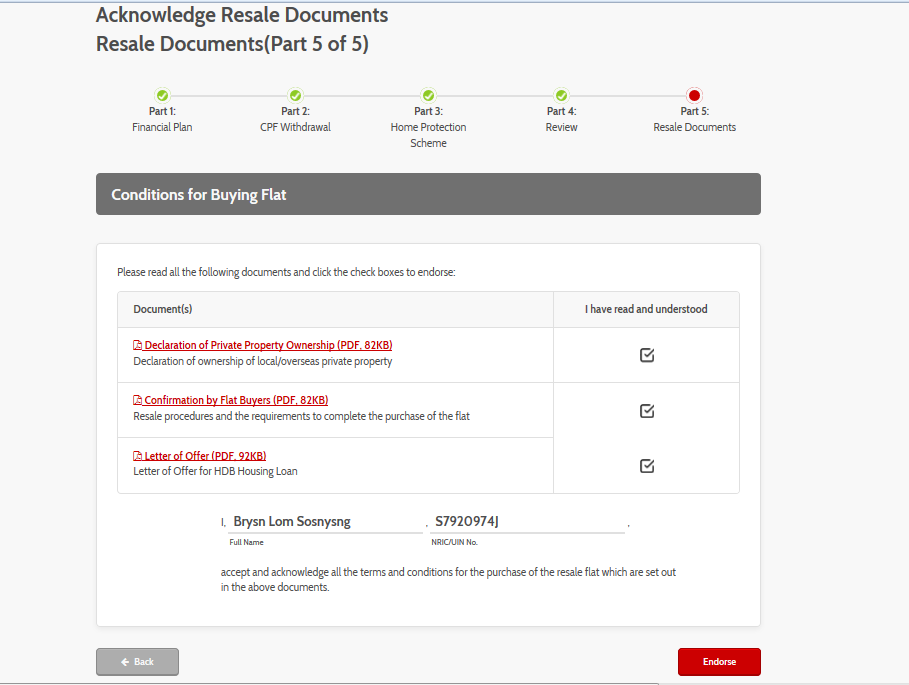

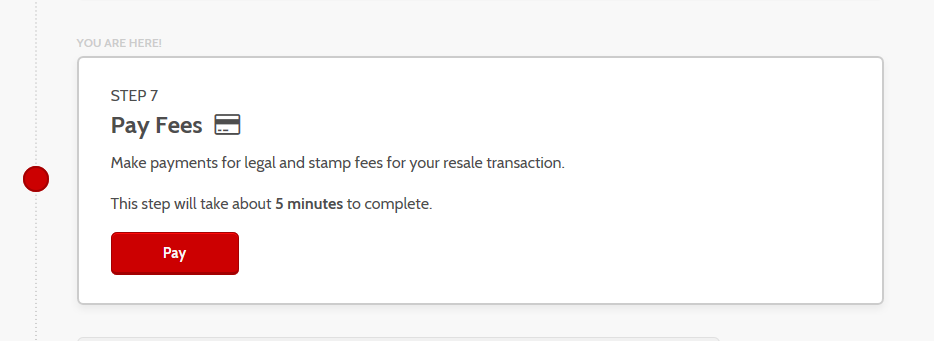

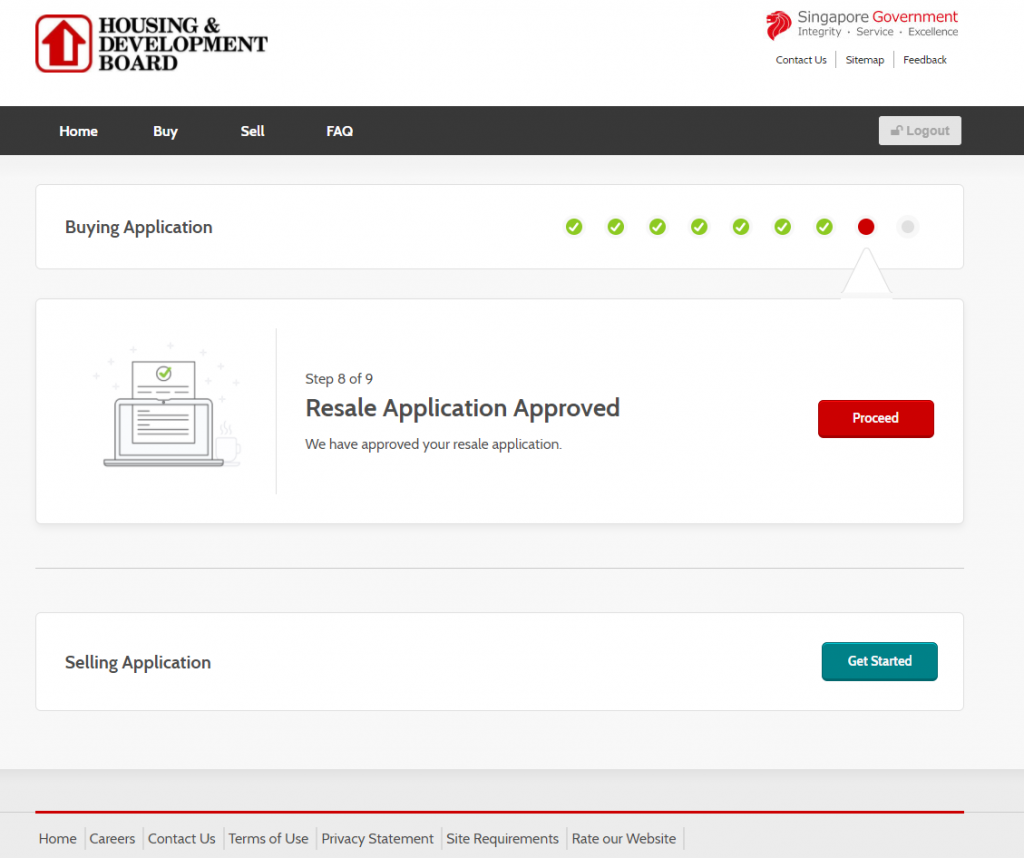

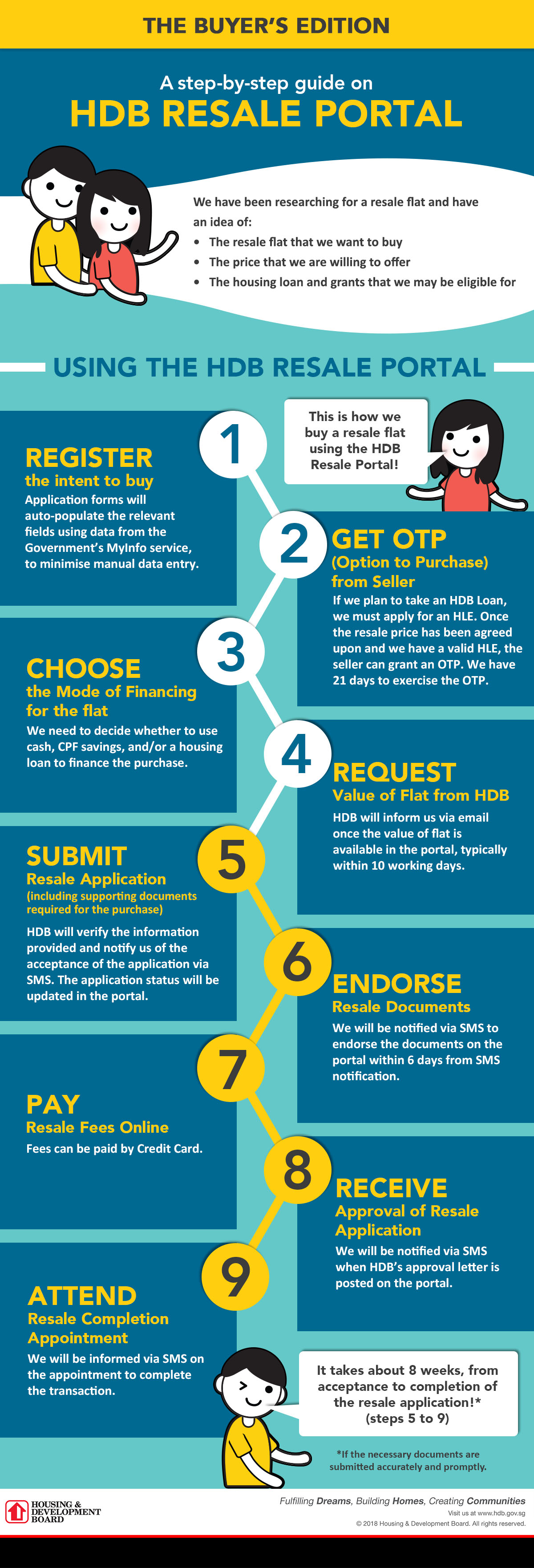

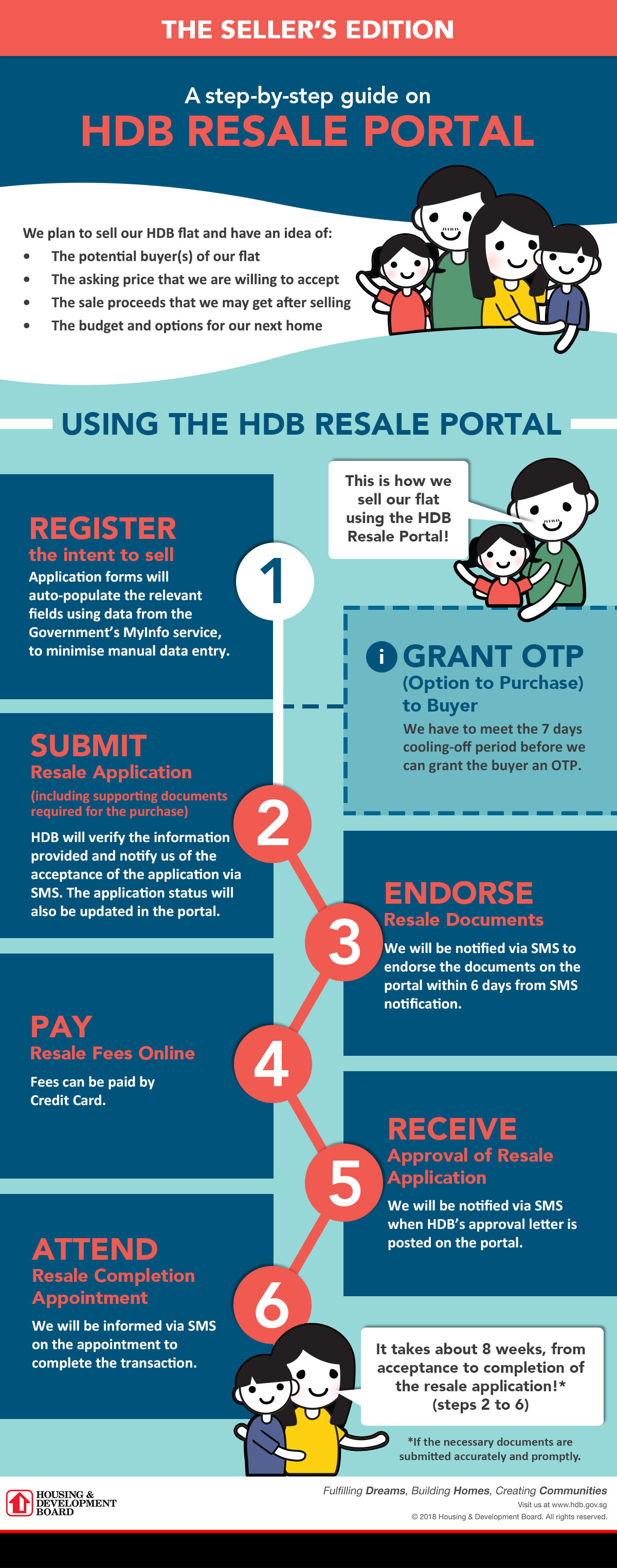

MoneySmart Tip: Besides going through an agent, buyers and sellers can use the HDB Resale Portal to perform their own resale transactions. The portal will guide you on the buying journey and help you track the progress of your transaction. The resale process takes approximately 8 weeks to complete from the date of HDB’s acceptance of the resale application.

MS: How did you plan your finances? What were your goals or considerations?

Mr Ismail: For me, I chose to pay off this flat fully. I know it might seem a little “old school”, but we believe that we should just keep our money in CPF and use that for retirement.

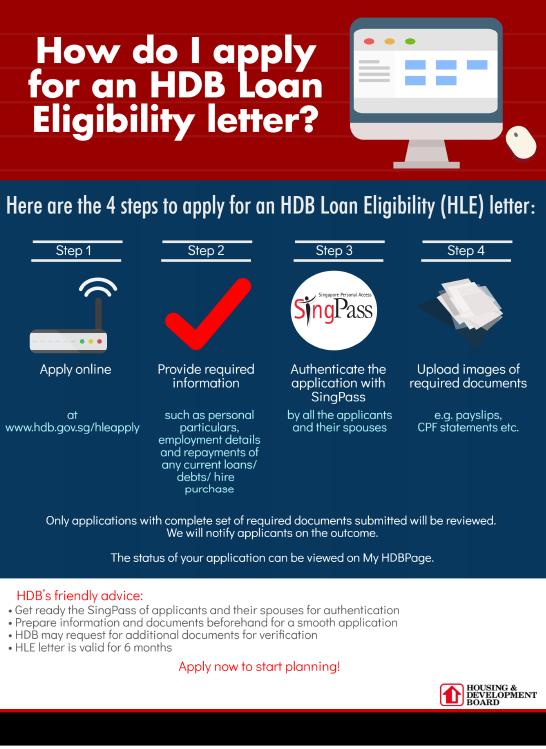

For our previous homes, we also chose to take a loan from HDB. My wife works in a bank, so we understand that there are benefits and risks to taking a bank loan, and we ultimately settled on getting an HDB loan. Now that we’ve paid off this flat, we don’t have to worry about a mortgage anymore, and we can focus on planning for retirement.

MS: And what sort of grants did you get for your home?

Mr Ismail: At the start when we got our first place after we got married, we were eligible for a grant for first time buyers, and of course we were aware that we could get $20,000 in Proximity Housing Grant for this flat as we were moving near my parents.

MS: Your home looks really nice and comfortable. Did you have to renovate it a lot, and how much did you spend?

Mr Ismail: We spent about $38,000 on our renovations. We did have to do quite a bit of work, which included your regular maintenance such as repainting the place and redoing the flooring and doors. The main issue with the place was that the wiring wasn’t done properly so we had to redo everything because they were crossed all over the place. The kitchen was also rather old so we gave it a refresh.

MoneySmart Tip: Figuring out what grants you are eligible for is an important part of planning for your home purchase. You can also get more information on financial planning for your home over at HDB’s InfoWEB.

MS: Can you share with us some thoughts around owning a home in Singapore?

Mr Ismail: For me, I never intended to buy a flat to profit from it. I plan to stay here with my wife till we pass on. Some people talk about leases expiring, but my perspective is that you are probably not even going to be alive when that lease expires, so why worry about it? As for my children, they will probably move out and buy a flat of their own, so I am not too worried about what happens with the lease.

There are many things that might change in the future which you have no idea about, so you plan for what you can. Other than that, I feel blessed to be able to say that I own a home, which is more than what many other people in other developed countries can say.

MS: Any other words of advice for homebuyers?

Mr Ismail: Go with what you are comfortable with. At the end of the day, you can overthink, but when you step into a neighbourhood, just ask yourself whether you feel like you belong there . Are you comfortable with the place and its surroundings? Is it a place you feel your children can grow up in?

Convenience is another factor. It might be more important for you to be near a supermarket than an MRT station. Whatever the case, understanding your needs is important. Small inconveniences can become a big deal over the course of a few years.

Source: mynicehome.gov.sg