A Guide to the HDB Flat Portal for BTO Buyers

Planning your flat purchase is now easier with the new HDB Flat Portal – a one-stop platform for flat buyers to gather housing-related information and plan their housing budget. We break down the portal’s many useful features in this step-by-step guide on how you can use the HDB Flat Portal for your BTO application!

| Content |

| 1. Work Out Flat Budget With the Budget Calculator • Fill in household and financial information • Estimate the housing loan amount from HDB or financial institutions (FIs) • Adjust loan amount and repayment period based on affordability • Understand the considerations when taking a housing loan from HDB or FIs |

| 2. Find a Flat on HDB Flat Portal • Search for flats based on estimated budget • Browse through available flats • Shortlist and compare flats |

| 3. Check Flat’s Payment Plan With the Payment Plan Calculator • Find out the estimated costs and fees for intended flat • Receive housing loan estimates for intended flat purchase • Check the payments required at different milestones |

| 4. Apply for a Flat • Submit flat application • Receive notifications for shortlisted units |

Work out your Flat Budget with the Budget Calculator

As with any big purchase, it’s good to start by working out your budget. This will help you shortlist suitable flats that you can afford, and here’s where the budget calculator on the HDB Flat Portal comes in handy! The budget calculator helps you calculate your housing budget by considering your CPF and/or cash savings, probable CPF housing grants, and amount of estimated housing loan from HDB or the FIs.

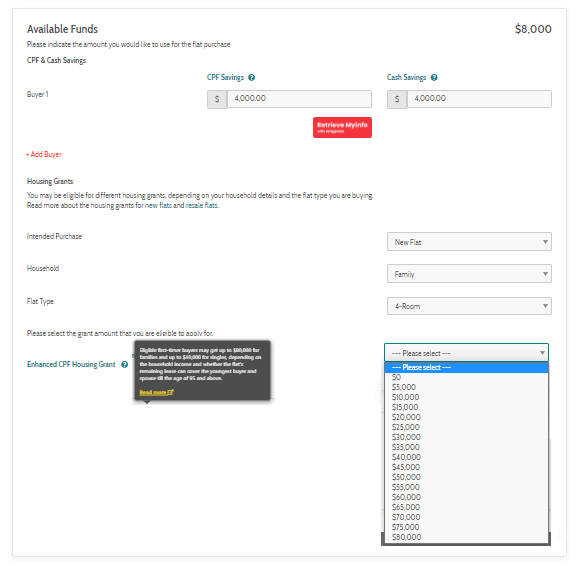

Step 1: Fill in your household and financial information

On the menu bar, select ‘Calculators’ followed by ‘Check My Budget’. Enter your available CPF and cash savings, household income, and flat that you intend to purchase. Based on the information, the type of housing grant and probable grant amounts will be shown. You can find out more about housing grants eligibility by clicking on the “Read more” link in the tooltip.

Step 2: Estimate housing loan amount from HDB or FIs

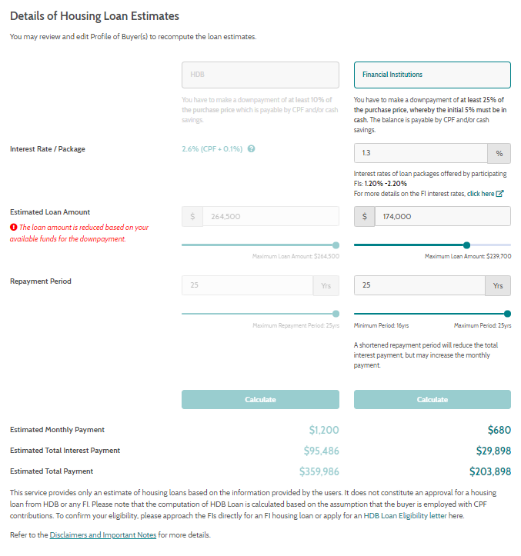

Next, if you are considering a housing loan, you can obtain from HDB and the FIs an estimate of the housing loan amount that you would be considered for. Start by selecting your financing option ie. housing loan estimates from HDB or the FIs.

Can’t decide between the two? You may compare the estimated loan amount, interest rate, monthly payment, total interest payment and conditions for each financing option. The calculator also provides a list of interest rates on housing loan packages from participating FIs. You may refer to this to indicate a preferred interest rate for the computation of the FI housing loan estimate.

Do note that the housing loan computation are estimates based on the information you have provided and does not constitute an actual approval for a housing loan from HDB or the FIs. You may wish to reach out to the FIs if you require clarification on your eligibility for a housing loan.

Step 3: Adjust loan amount and repayment period based on affordability

You can adjust the loan amount, repayment period or the FI interest rate to understand the differences in estimated monthly repayment and total interest payment for each combination. The loan amount will be adjusted accordingly, should there be insufficient funds required for downpayment for the flat purchase. Your estimated housing budget will appear at the top of the page.

Step 4: Understand the considerations when taking a housing loan from HDB or FI

There are various factors to consider when taking a housing loan. Understanding the terms and conditions of each loan options can help you make an informed decision before purchasing a flat.

With an estimated flat budget in mind, it’s time to look for a flat! Click on ‘Search for Flats’ under ‘Related Services’ at the bottom of the budget calculator. This will lead you to the ‘Finding a Flat’ page where the available flats within your computed budget would be populated. You can also access the page via the menu bar of the HDB Flat Portal.

Find a Flat on the HDB Flat Portal

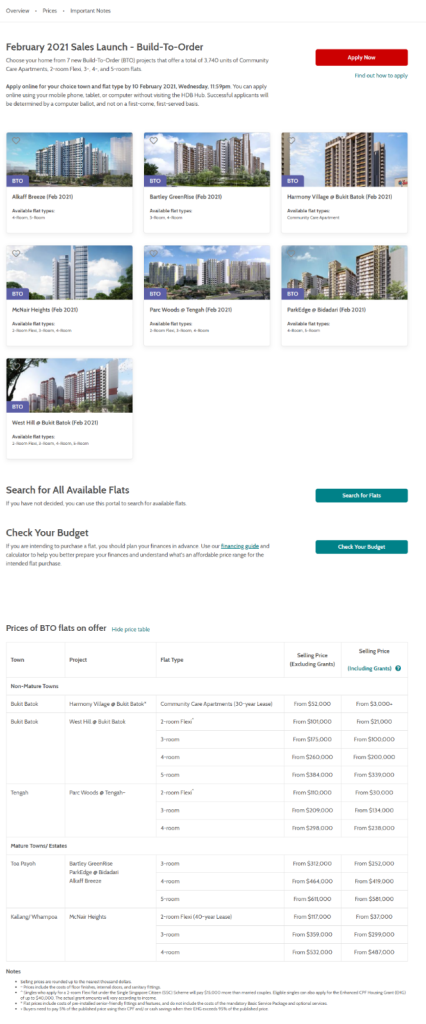

The HDB Flat Portal lists current and upcoming BTO and SBF flats during sales launches and flats for open booking. In this article, we will focus on BTO and SBF flats.

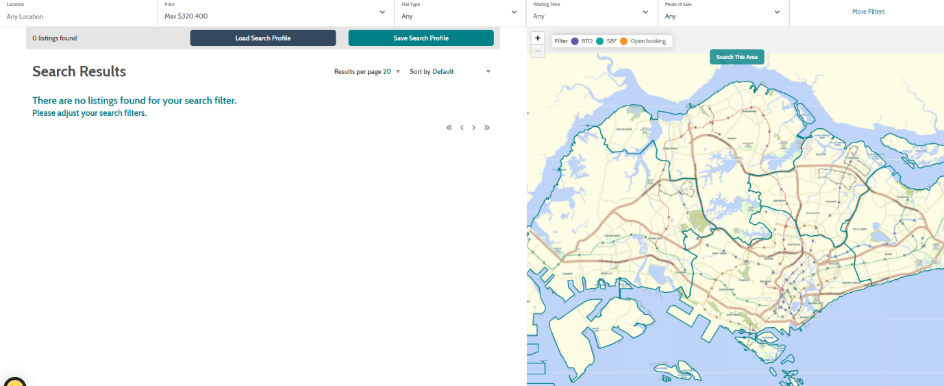

Step 1: Search for flats based on your estimated budget

Search for the flats by location, price range, flat type, waiting time and other criteria. You can also import your estimated housing budget from the budget calculator into the maximum price search filter.

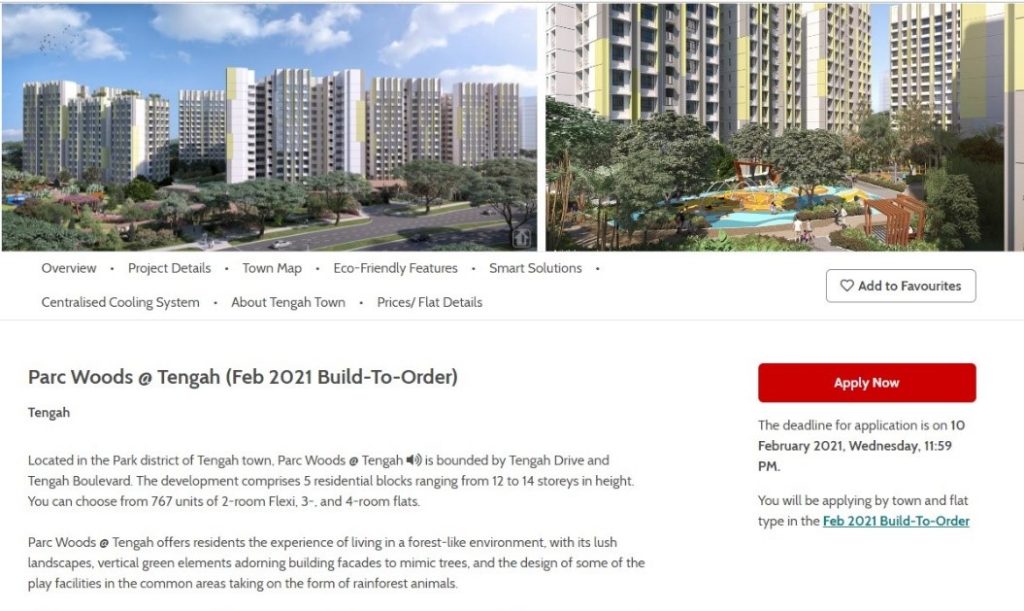

Step 2: Browse available flats

During a sales launch, a banner will appear on the HDB Flat Portal’s homepage. Clicking on this will lead to a page with information of the projects on offer.

Step 3: Shortlist and compare flats

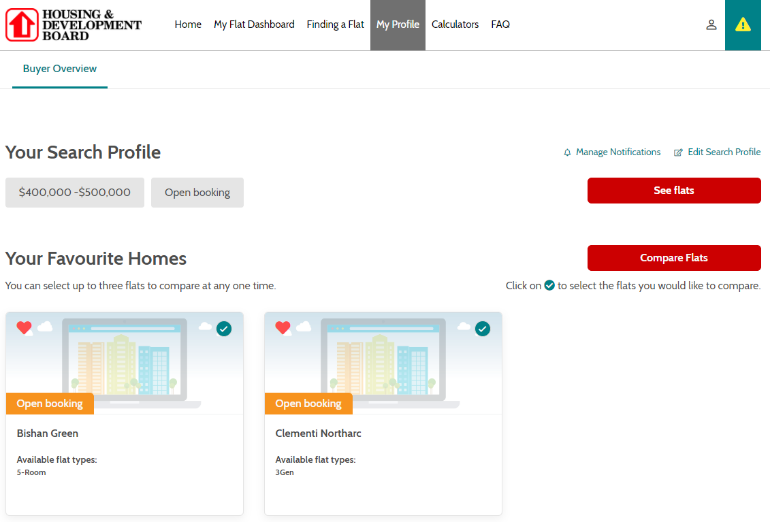

Shortlisted several flats that you like but can’t quite decide yet? Click on the heart-shape button to save them to your favourite list for a side-by-side comparison later. You can add up to 10 homes to your favourite list for comparison.

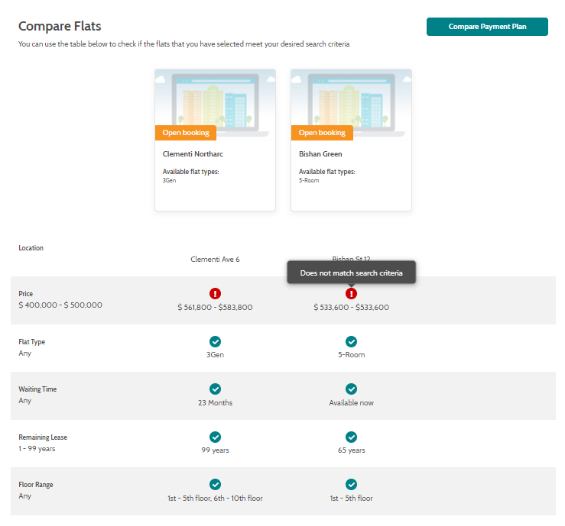

For flat comparisons, click on ‘My Profile’ on the menu bar. Under “Your Favourite Homes”, select up to three listings and click ‘Compare Flats’ to compare their location, price, flat type, waiting time, remaining lease and floor range. Attributes that do not meet your saved search profile will be indicated with a red exclamation mark.

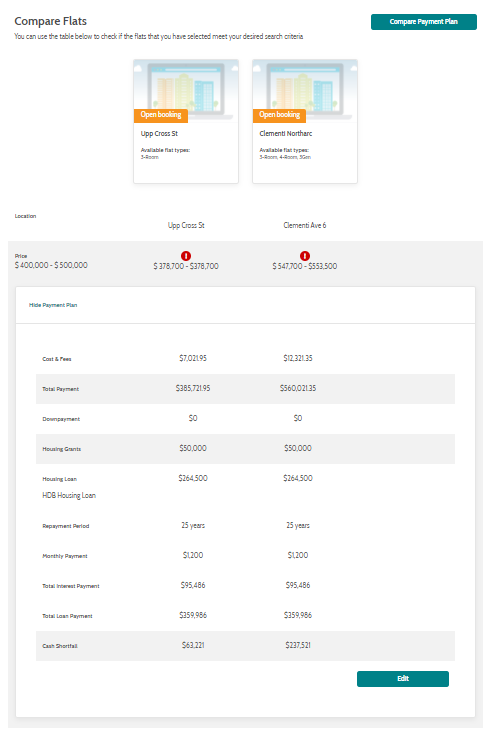

You can also compare the estimated cost and fees, loan amount, total interest payable, monthly repayment and more for the selected flats by clicking on the ‘Compare Payment Plan’ button. This will bring up the payment plan calculator. Simply fill in the missing information, scroll to the bottom and click on ‘Show Comparison’. Hop over to the next section for more information on the payment plan calculator.

Check your Flat’s Payment Plan with the Payment Plan Calculator

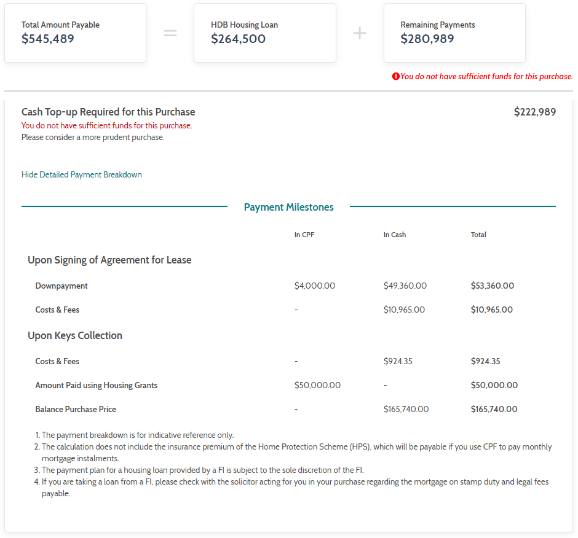

If you have a preferred flat in mind, use the payment plan calculator to understand the payments involved for the different milestones, and find out if you have sufficient funds to finance the flat purchase.

The calculator checks the price of the flat against your available funds, probable CPF housing grants and estimated housing loan amount from HDB or the FIs, to determine if you have sufficient funds for the intended flat purchase. It also shows a breakdown of the cash and CPF payments required at various milestones of your flat buying journey to help you plan ahead .

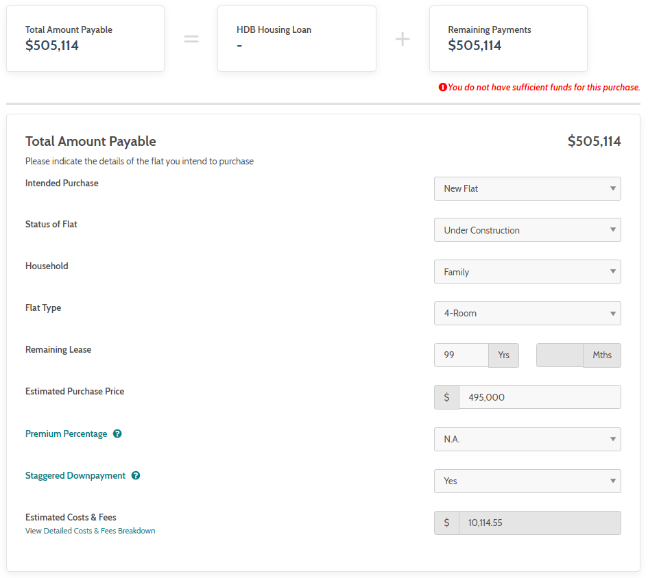

Step 1: Find out the estimated costs and fees for the intended flat

Enter details of the flat that you intend to purchase. The estimated costs and fees related to the flat purchase will be calculated and added to the price of the flat, to form your total amount payable. You may also view a detailed breakdown of the costs and fees.

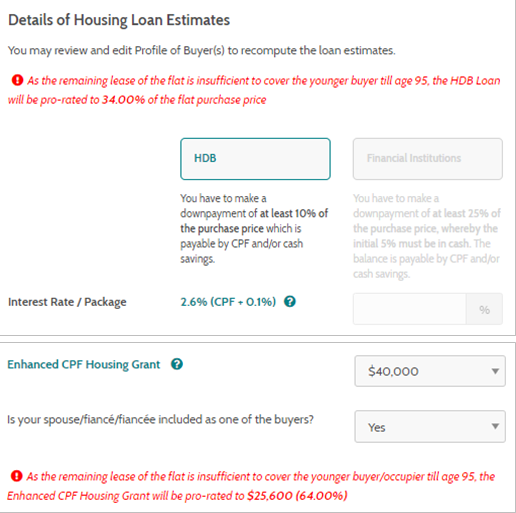

Step 2: Receive housing loan estimates

Remember the budget calculator? This section will be pre-filled based on the information you have provided in the budget calculator (note that the fields will only be pre-filled when the same browser tab is used for computing figures on both calculators).

If the remaining lease of the flat does not cover you or your spouse till the age of 95, the estimated HDB housing loan amount and Enhanced CPF Housing Grant amount will be automatically pro-rated.

In the above scenario, you will be advised to visit the CPF Housing Usage Calculator to work out the estimated amount of CPF savings you can use to purchase the flat.

Step 3: Check the payments required at the various milestones

After deducting your estimated housing loan and available funds (CPF and cash savings) from the total amount payable, you will be shown a detailed breakdown on the amount of CPF and cash payment at different milestones.

The calculator will also alert you if you have insufficient funds for the flat purchase and show the amount of cash top-up required.

Apply for a Flat

During a sales launch, information on the BTO and SBF projects on offer will be available on their respective pages. These pages will also include a link to an online flat application form.

Step 1: Submit flat application

Click on the application link and submit your flat application before the closing date. For BTO and SBF sales launches, do note that applications are not processed on a first-come-first-served basis. HDB will check on your eligibility to buy a flat and determine your queue position to book a flat through a computer ballot.

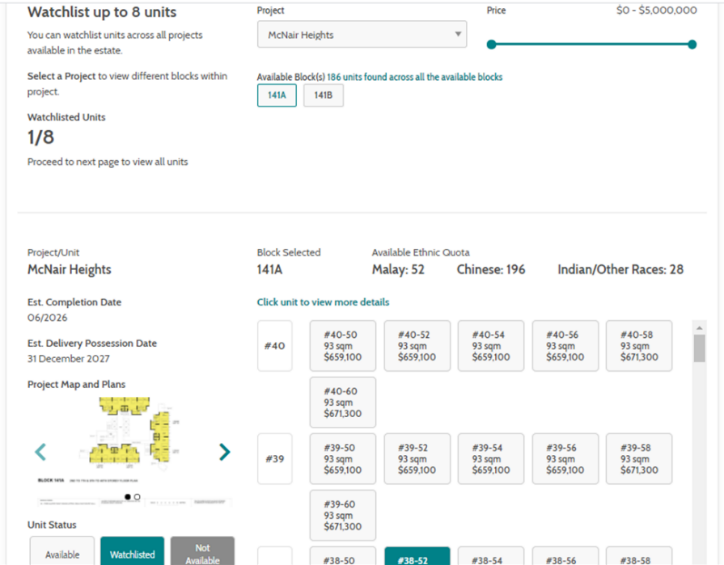

Step 2: Receive notification for units on your Watchlist

If you are invited to book a flat, you can place your preferred flat on a watchlist to monitor their availability. You may choose to receive email notifications when any of the units on your watchlist are booked. The link to the watchlist module can be accessed through the project details page under ‘My Profile’.

Ready to apply for your flat? Hop over to the HDB Flat Portal now!

Source: mynicehome.gov.sg