Why I Won’t Buy a Million-Dollar HDB Flat (and Why You Might)

It’s undeniable that the resale housing market is hotter than it was five years ago.

In the past two years, the prices in the broader HDB resale market have risen steadily. Pandemic-related BTO construction delays are one reason why.

Super low interest rates during the pandemic also drove up demand for homes, as people found it easier to take loans (this happened globally, not just in Singapore).

Another is more flats reaching their MOP, as these newer flats may command higher prices than older flats in the same location.

One phenomenon we’ve noticed is an increasing number of million-dollar HDB flats. Though they are only a fraction of the total HDB transactions, they’ve received a lot of attention.

Many of our readers have asked us whether it’s a good idea to buy these flats.

Here are my thoughts on why I (Ruiming) am strategically not inclined to buy one. And why this might apply to you.

Just to be clear: We’re not saying you SHOULDN’T buy a million-dollar HDB flat. Some people might have reasons for buying these flats, we’ll explain this later.

What makes a million-dollar flat?

A million-dollar resale HDB flat would typically have a few main qualities that allow it to command its hefty price tag.

The more of these qualities it has, the more likely it’ll reach the magical $1,000,000 price tag and beyond.

Location: The more popular a location, the higher price it will command. An extreme example would be this 43-year-old flat that was sold in Tiong Bahru for 1.1 million dollars in 2020. The buyer thought it was old, but gold.

Size: The larger the flat, the more expensive it will be. This gives flats in less popular areas the ability to command higher prices. The recently sold jumbo flat in Yishun is one example.

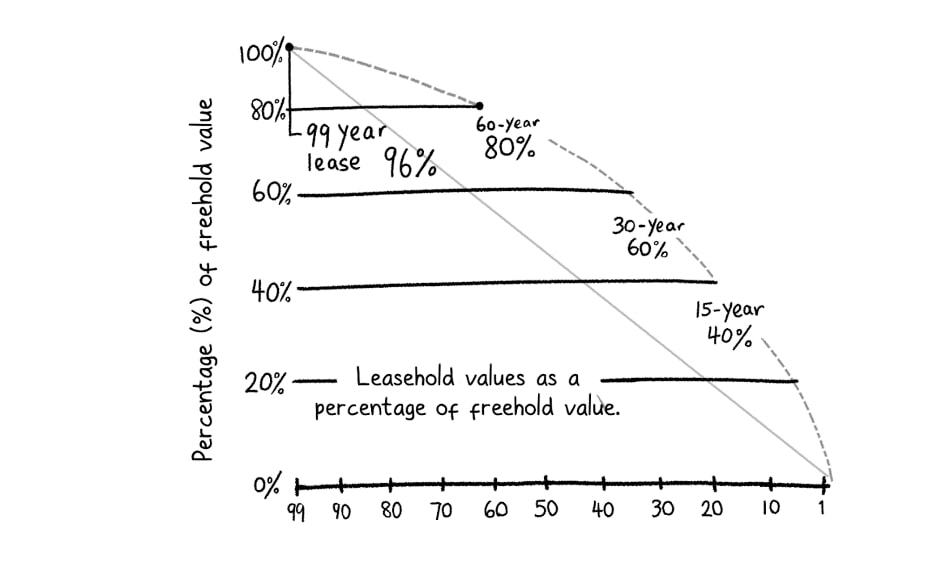

Lease: Generally, the newer the flat, the more expensive it will be, and vice versa. The Singapore Land Authority (SLA) has a rough guide known as ‘Bala’s Table’, which kinda shows how property prices are affected by their lease.

Older flats also have a limited pool of buyers, because if the lease of the HDB flat doesn’t last the youngest buyer till 95, there will be limitations on how someone’s CPF can be utilised.

Why is understanding Location, Size and Lease important?

Because these are effectively the trade-offs you have to make if you want to buy a home within your means.

Why you might not want a million-dollar flat

Why?

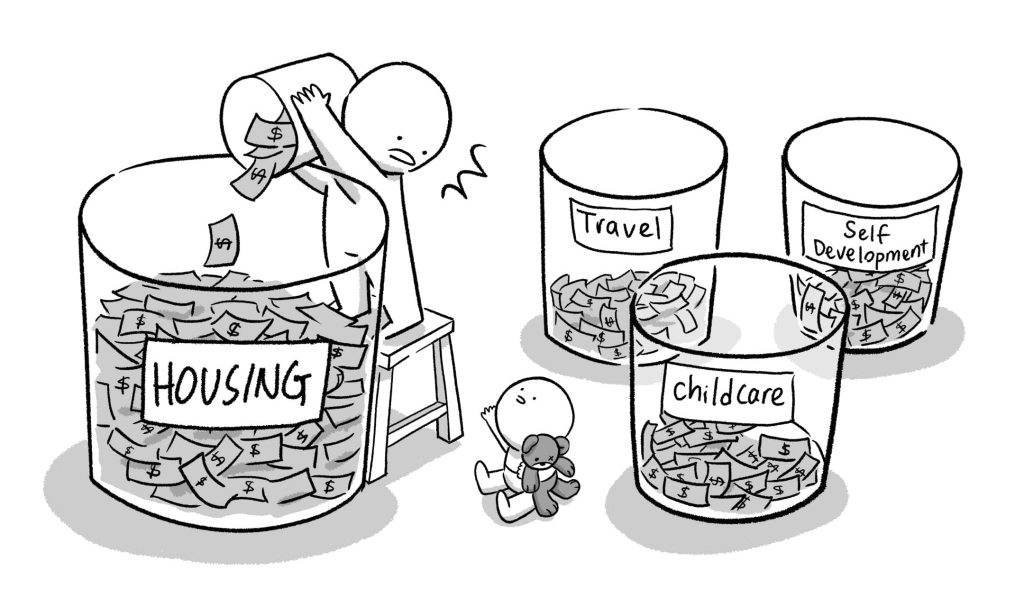

It’s for the simple reason that more money spent on my home means less money elsewhere. As the saying goes, every decision for something is a decision against something else.

These are some things I’d keep in mind while buying a home.

Financial security:

Buying an affordable home means financial security during turbulent times.

If history serves as a guide, our adult lives – like our parents’ – will have its share of economic highs and lows. This could mean times of unemployment and uncertainty.

By buying a flat well within your means, you’ll need to worry less about your mortgage in bad times.

While millennials have only known the era of low interest rates, it’s important to remember this isn’t always the case. Singapore Interbank Offered Rate (SIBOR) actually hit interest rates of 3.56% in 2006, and home loans upwards of 7% during the late 1990s.

Case in point: Some readers who’ve signed up for floating mortgages during the pandemic are beginning to worry about interest rate hikes. They should. Paying 3.85% vs 1% interest on a six-digit loan definitely adds up!

Also, despite recent events, it would be wise to remember that prices of HDB flats don’t go up all the time.

From 2013 – 2019, both public and private property prices were on the decline. The same can be said for the late 1997, where the HDB resale index fell by almost 30%, and only recovered in 2008.

Those who’re thinking of treating their flat like an investment, take note!

Don’t pay *too much* for centrality and convenience

“Time is money.

So, if you’re financially savvy, shouldn’t the smart thing be to save time, by living in a mature, central location closer to the CBD?”

This is something people often say to us when we advocate buying a more affordable but less centrally located home.

While I see the logic, perhaps it’s worth considering the following points:

More centrality and convenience always costs more. This is the same whether you’re in London, Tokyo, Paris, or Melbourne. If you need to spend a lifetime working to pay this difference, it might not be worth paying for.

For example, it might make sense for a couple earning a combined income of $20,000 to buy a $900,000 flat in a central location to save time. They can comfortably afford the payments, and it makes sense to reduce their commute time.

However, if you need to borrow money from your parents, or look for ways to get around the loan limits offered by financial institutions, it’s usually a sign you cannot afford the convenience you desire.

Not all workplaces are in the CBD. There are many smaller commercial centres around the island. Jurong East, Paya Lebar, Changi, One-North etc. Even if you work in the CBD, with flexi-work arrangements you might go into the office less and less.

If you intend to buy a car or a motorcycle/scooter (like many people do), then centrality might not matter as much. You are effectively already paying for convenience when you decide to own private transportation.

Finally, in places not as well served by public transport, some creativity can go a long way. Speaking from first-hand experience, I’ve found that using a bicycle can often help you get to your destination faster if it’s less than 10 km away. Otherwise, you can still use a bike to cover that last mile to the MRT station.

If you are able to make this lifestyle change and your workplace is supportive, you might not need to fork out hundreds and thousands of dollars for that unit in a central location.

Paying for space you don’t use:

As someone who might not have lots of kids (or even remain child-free), a large flat is wasted on me (and by extension, I’ll be wasting money on a larger flat).

Sure, having more space is always a luxury in land-starved Singapore. Or any city.

The question is whether it makes financial sense.

Don’t get me wrong; I like to have enough personal space. But not at the expense of my freedom to do other things.

For reference: I currently rent a 3-room HDB flat with my girlfriend that’s about 700 sq ft. It’s serviceable, though I certainly could be happier with 900 sq ft.

Do you have enough for other life goals?

A roof over your head is important. But I dare reckon that it won’t be the only aspiration you have in life.

My own personal goals include:

- Experience working overseas at some point in life ($200,000 for living expenses) / be a digital nomad

- Embark on a year-long cycling trip ($100,000)

- Be able to choose to do a job that I like (have a passive income of at least $2,000 a month)

If I spend too much on a house, these goals will remain just that – dreams. Every single extra dollar spent here moves me further away

from reaching these goals.

Mind you, even if you do not know what your other life goals are, I think it doesn’t hurt to be cautious about overpaying for a home. The home you buy can limit the dreams you can chase.

So if you’re considering buying a million-dollar flat, weigh the opportunity costs of spending that sum on housing and ask yourself if you can live with the trade-off.

So why do people buy million-dollar flats?

I’m just going to say it: I think buying a million-dollar flat is a bad idea for the median-income Singaporean because of budget constraints.

That being said, above-median-income Singaporeans do exist. They can afford these expensive flats, and find them attractive despite the price tag.

Consider this: A million dollars for an HDB flat is certainly a lot of money, but to get a condominium of equivalent size at a comparable location will cost at least 3-5 times more!

In such scenarios, buying a million-dollar HDB flat may be more appealing despite the lack of private facilities.

So yes, a 1000-sqft HDB at Pinnacle @ Duxton may set you back a whopping $1.25 million, but the condo alternative for the same neighbourhood, a 1,098 sq ft Wallich Residence condo will cost triple the price at $3.87 million.

A final word about affordability

Yes, there is little question it’s a seller’s market right now. And will be for a while. Be prepared to pay more than pre-pandemic times.

However, what is also true is that there are many choices on the resale market.

The cheapest HDB flat on PropertyGuru is asking for $250,000 as of the writing of this article. The most expensive one? An eye-popping $1.65 million.

Our advice? Calculate what you can afford first above all else. Use your judgement to determine whether the seller’s asking prices are reasonable.

If you want to be extra safe, buy something below your means.

Otherwise, for peace of mind, buy something within your means.

And unless you want to spend the foreseeable future stressing about paying your mortgage, never spend beyond your means.

Stay woke, salaryman

A message from our sponsor, HDB

There are many factors that come into play when looking for a new home – the location, proximity to loved ones and amenities, size and more.

But amongst all of these, affordability is one of the key factors in making a housing decision. After all, housing would likely be one of your first biggest ticket purchases, so it’s important that your future home fits your budget and your needs.

If you’re looking for a new home, check out the guides, articles and resources available on MyNiceHome.

Also, check out past content pieces we’ve developed with HDB to navigate through your home-buying decision:

Source: mynicehome.gov.sg